It's been quite a week. And, it's been quite a couple of years. Certainly, we've all had a lot to comprehend about the state of the world, with the pandemic beginning in 2019-2020 and now the Russian invasion of Ukraine.

From an economic perspective, the pandemic has rolled through various asset classes, at first favoring "stay-at-home" and technology companies, and then cycling through to more established industrial and consumer staples. At the same time, the impact of supply chain constraints has affected the inflation picture and caused more focus on commodities and dividend-paying securities. The events of the past week have only increased the importance of those asset classes.

With the increasing uncertainty of the geopolitical situation and its effects on the global economy, it's time to take a step back and look at the big picture.

First off, my read of the developments in Ukraine lead me to the following immediate thoughts:

1. God bless the Ukrainians - their grit, bravery, and sarcastic wit about the entire thing has given them a special place in my heart, and in the hearts and minds of a majority of people throughout the world. Make no mistake, their ability to hold onto their country and drive out the evil aggressor is crucial. The world must do everything possible to prevent a Russian victory.

2. This will serve to strengthen NATO further, regardless of the outcome. But, I really don't see a negotiated settlement happening any time soon, as there is no benefit to the Ukrainians to give an inch to Russia, and the unhinged maniac Putin will try to save face in the midst of an embarrassing miscalculation for him and his cronies. The Russian people will ultimately have to change their leadership in order to ever be perceived as trustworthy and reliable business partners.

3. China's reaction to this situation will be telling. Does China want to be a productive global partner or an enabler of an evil empire? The world is watching.

4. Fortunately, NATO is holding strong and proving the value of the alliance. The financial sanctions appear to be punitive as intended. Hopefully, this situation can be resolved before the ripple effects cause too much collateral damage.

5. Regime change must happen in Russia. The Russian people deserve better and have been held hostage for years by Putin and his inner circle. For them and the world to move forward from here, this must happen. How this happens remains to be seen. Will it be due to internal pressure, or a further miscalculation by Putin? If the latter, we could be in for a long road here.

If you are so inclined to take action to help Ukraine, here are some resources that The Washington Post referenced in an article yesterday:

- Voices of Children - helping with evacuations of children and families.

- Kyiv Independent - help Ukrainian journalists keep the media going.

- Help Chef Jose Andres and World Central Kitchen feed people in need in the region.

- Razom for Ukraine was launched in 2014 and is focused on purchasing medical supplies. You can donate here: https://razomforukraine.org/donate/

- Care.org is coordinating donations for people in need.

- Sunflower of Peace - a small nonprofit with ambitions to help Ukrainian orphans and internally displaced people.

- Donate to help Ukraine's military through the National Bank of Ukraine.

Now, on to thoughts regarding the impact of this situation on investment strategy and financial planning.

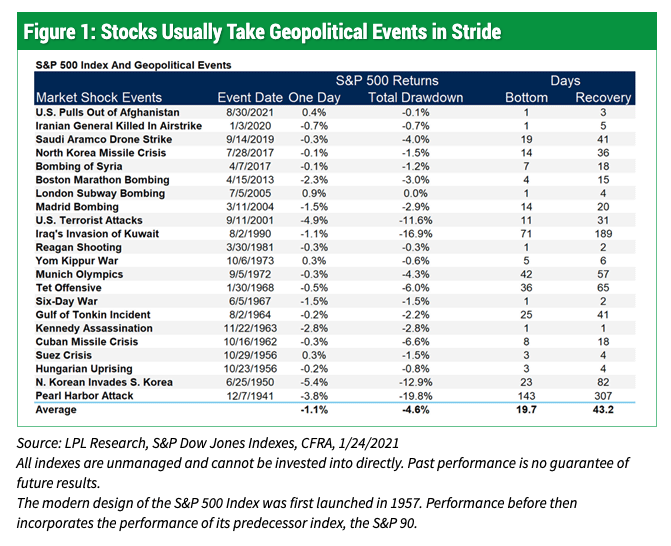

1. Stocks tend to recover from geopolitical events relatively quickly. The following charts show how various historical events impacted the S&P index and the number of days for recovery:

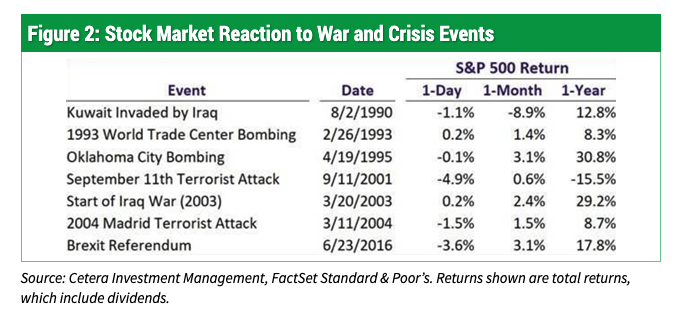

2. Additionally, stocks tend to do well after major crisis events:

The unknown in all of this is where this crisis fits into this analysis. We don't know where this crisis is going. Will it be similar to the Kuwait situation? The start of the Iraq war? September 11? Something worse? At this point, we don't know, but much of our evolving investment strategy over the last few years would appear to be directionally correct. Here are some of my thoughts about what we've been doing and possible strategy changes:

1. Cash and bonds have been less of an emphasis due to inflationary / interest rate pressures. This will probably continue to hold given this situation.

2. We've been analyzing and carefully implementing a greater focus to commodities and alternative assets (for example, the Goldman Sachs Commodity Strategy Fund - GCCIX, Van Eck Green Metals fund - GMET, and domestic real estate investment trusts). Expect continued focus on these asset classes and possibly higher allocations in these areas.

3. Our individual stock portfolios are reviewed monthly and we are making appropriate changes where necessary.

4. We started using hedged equity funds (such as the Anchor Tactical funds and Redwood Investment strategies) prior to the pandemic in an effort to add some downside protection to stocks, while maintaining our allocations to them. We have not reduced our exposure to such products, and will consider raising our allocations to them when necessary.

In brief, you should know that we are watching the situation closely, and will make adjustments as needed. We do not currently see the need for drastic strategy changes, as patience normally proves to be the right course of action.

If you have any questions, or if you would like to schedule a discussion with me regarding your personal plan, please contact my assistant, Elizabeth Raby-Salinas at elizabeth@artifexfinancial.com.

With warm regards,

--Doug Kinsey, CFP®, CIMA®

Partner, Chief Investment Officer

For a more in-depth look at the evolution of this crisis, and commentary on the Russian situation, read "Top of Mind - Russia Risk" from Goldman Sachs Global Macro Research.