Today, I am starting a blog post entitled "Lessons Learned" where I will attempt to impart some thoughts and accumulated knowledge (I'd say wisdom, but that sounds a bit haughty) that we've gained over our years of practicing financial and investment advice. We started our firm in 2007, right before the economic crisis of 2008, and we certainly learned some lessons back then. Since then, we've confronted numerous mini and macro-crises...on a regular basis. We've had to make decisions all along the way regarding portfolio allocations, and economic effects on our clients financial plans. Sometimes the situation calls for changes, but many times it does not. With this blog, I'll try to give you some insight into how our mental models factor into our decision-making, as well as other ideas that may help you develop your own models for better decisions.

The current coronavirus crisis has created a situation where we are once again hit with numerous ideas and thoughts from the investment management industry. For example, I received an idea from a mutual fund company this morning regarding a stock fund that purports to manage risk using options strategies - in other words, hedging the up and down side by using options. Certainly something to consider, right? The trouble is, a lot of these solutions don't really add much to a portfolio over time, and an investment manager runs the risk of buying into something that will only be a temporary solution, and may actually detract from a client's portfolio.

It's a good thing for you that our firm invests a fair amount of money in tools to help us evaluate ideas like this. So, I'll show you my initial thought process on this using one of our evaluation tools. Understand, I am not trying to diminish the idea that was brought to my attention, as it may be perfectly suitable for the average investor who doesn't work with an experienced advisor, but for us, it does not offer much of an advantage compared to solutions we already have.

So let's dig in. The fund idea that arrived in my inbox is the Gateway Fund Institutional Class (GTEYX), which is designed to use options strategies to offset downside risk. While it does have lower volatility and is less correlated to equities, my first thought is to compare it to another fund that we use currently, the Anchor Tactical Equity Strategies Fund(ATESX), which is also a risk-managed (hedged) equity fund with a 5-star Morningstar rating.

Using our factor-analysis software to compare these two funds, here is what I determined:

This chart shows a comparison of the two funds from a Fama-French Five Factor perspective. Some similarities regarding the various components of the FF model, which looks at the composition of the underlying holdings according to factors that Eugene Fama and Kenneth French identified as having impact on the performance of a portfolio - namely a heavier weighting toward the following:

- Size - smaller companies tend to earn excess returns.

- Profitability - more profitable companies outperform less-profitable ones.

- Value - companies identified as having higher intrinsic or book value compared to their current price outperform those that are more highly priced compared to their book value.

- Equity - How much of the return is explained by the fact that the portfolio is comprised of equities vs. the one-month T-Bill.

- Investment - Companies which invest their capital less aggressively outperform those who spend their money more aggressively.

So, although this chart is interesting, it doesn't really tell us much other than we'd probably expect this to look as it does, given the focus of these two funds. It provides us no compelling reason in this scenario to select one over the other. We'd pay more attention to it if we were evaluating two funds that were purely stock or bond oriented. In that case, it would give us additional insight into whether or not we were getting what we paid for.

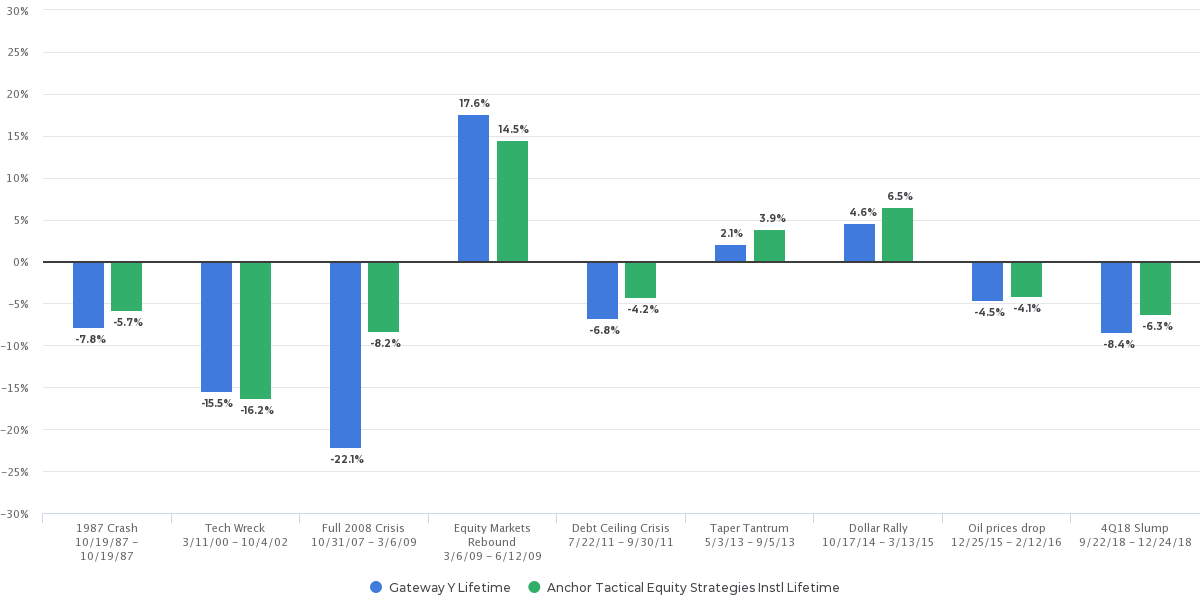

It starts to get more interesting with the next chart:

Here we see how the two funds would have performed over various market events going back to 1987. Since we are mainly concerned with capital conservation and risk management, this is an important piece of the analysis. We can see that our existing option, Anchor Tactical Equity Strategies, is much better at managing downside risk, based on its factor weighting. It only underperformed the Gateway fund during the Tech Wreck of 2000-2002, and performed very admirably during the 2008 financial crisis. So, score one for ATESX.

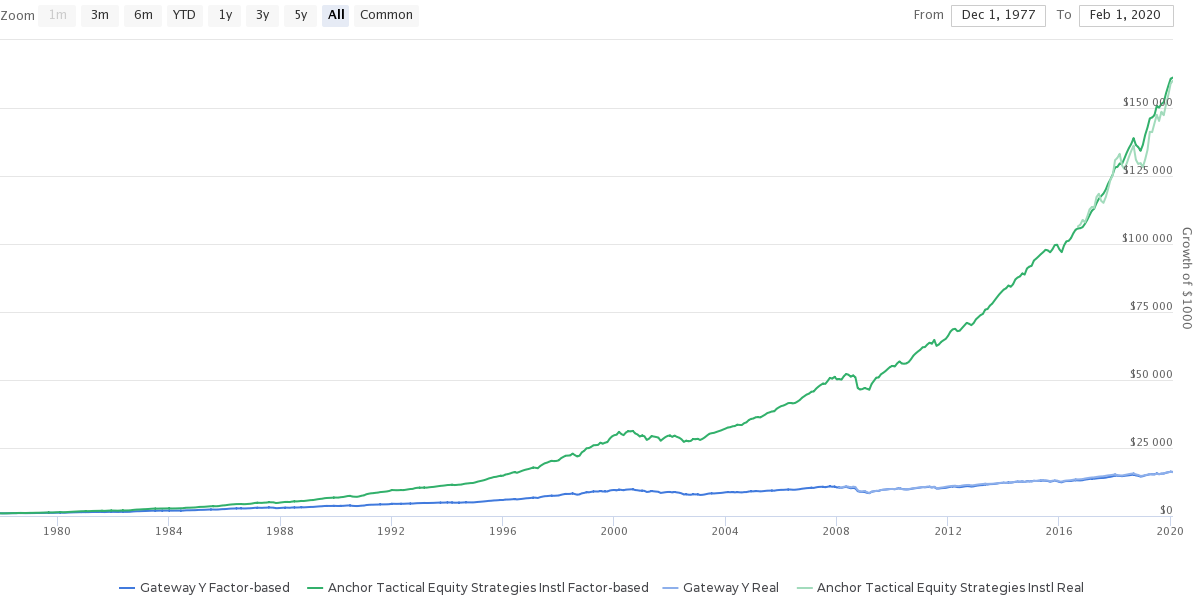

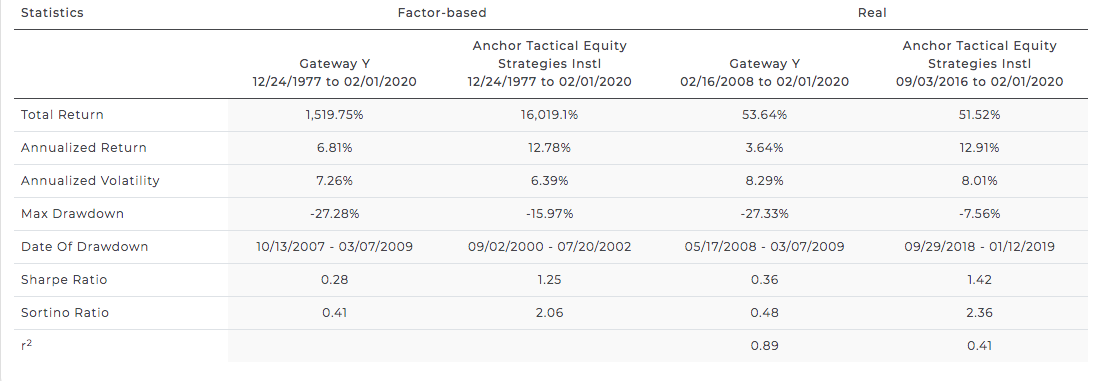

Finally, we'll look at how the two funds have performed since their inception dates, in the following "growth of $1000" chart:

So, it's pretty easy to see that the historical and hypothetical returns of the two funds indicate that ATESX is the better choice here. In addition to a much higher annualized return, with slightly lower annualized volatility, ATESX provides a higher Sharpe Ratio (a measure of return vs. risk), Sortino Ratio (return vs. downside risk) and less correlation with the benchmark (r2).

This, and other considerations guide our conclusion that if we need to utilize a risk-managed equity fund, we'll choose ATESX over GTEYX.

This should give you some insight into one step of our investment decision-making process. We can run scenarios on any asset, or asset class with this tool, and others that we employ to inform our decisions.

An important caveat here - we are not recommending that our readers buy either one of these funds - this information is merely being provided for illustration purposes.

Certainly reach out to me directly if you have any questions or thoughts.

Doug Kinsey, Partner, CIO

Artifex Financial Group

doug.kinsey@artifexfinancial.com