Earnings Season

October 18, 2021

Equity prices at home and abroad have traded higher since the end of a disappointing September. US stocks are nearing the top of the trading range that has bounded prices since late July.

Through the first half of October, the broadest domestic benchmark indexes have risen roughly 3.8%. Narrower indexes such as the Dow Jones Industrials and Transports have enjoyed stronger rallies, gaining 4.3% and 7.6%, respectively. International Developed and Emerging Markets are up 2.5%-2.8% since quarter’s end.

Strong earnings from the financial sector provided fuel for investor enthusiasm last week. Early reporters such as JP Morgan Chase (NYSE-JPM) were typical of the group, posting a quarterly report that beat both revenue and profit estimates.[1] Reductions in loan loss reserves put in place during the 2020 slowdown have added boosts to operating profits. We expect this trend to continue through at least the end of 2021.

We can’t predict whether strong earnings reports will provide sufficient impetus for markets to surmount their summer and early fall highs, but what is clear is that liquidity in the equity markets is not lacking.

Selloffs have been short-lived affairs with momentum turning from negative to positive in virtually the blink of an eye. Closing prices of the S&P 500 over the 12 months ending October 15 are illustrated below.

Source: Quotestream online quotation platform, www.quotemedia.com

Bond prices have moved lower since the end of the third quarter with the weakest link in the Treasury market at the five-year point. The US Treasury yield curve continues to flatten (lose upward slope) as the shortest rates (other than the 3-month T-Bill, which the Fed continues to hold near zero) push higher more quickly than intermediate and long-term rates.

Normally, this action would suggest tightening credit conditions, but as long as the Federal Reserve remains an active, open market buyer of Treasury and mortgage securities, distortions in normal functioning of the credit markets must be expected.

Bond market investors could force the Fed to act sooner than it desires to control the uptrend in inflation. Credit markets have a long history of leading the Fed at inflection points, so a continuing uptrend in yields is possible, even likely, if inflation persists.

Commodity prices have resumed their climb after a pause during the summer. The Dow Jones Commodity Index has been probing all-time high territory the past two weeks, led by a steep uptrend in oil, gasoline, and natural gas futures.

Energy is the lifeblood of our economy, affecting virtually all manufacturing and raw materials processing costs. The sharp rise in crude since January is one of the most visible manifestations of the rising prices afflicting consumers. Meteorological forecasts of a deeply cold winter ahead have sparked warnings from the government that heating costs could rise more than 50% this year compared to 2020.[2] WTI prices over the past year are below.

Source: Quotestream online quotation platform, www.quotemedia.com

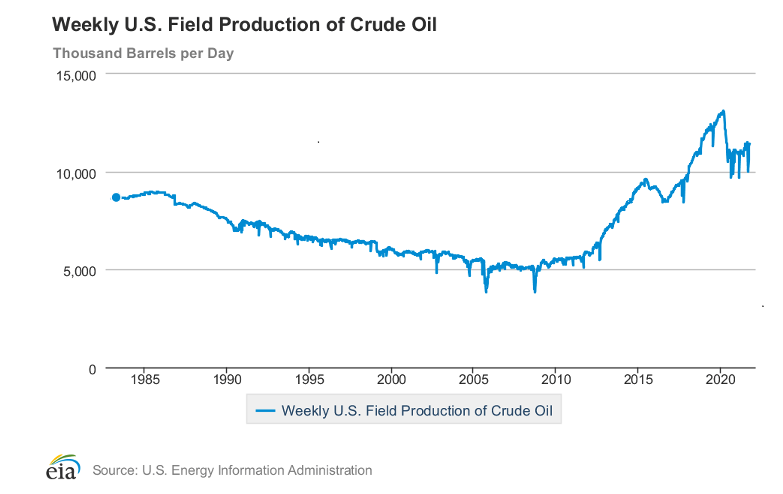

In January, upon taking office, one of Mr. Biden’s first acts was to halt construction of a major pipeline under construction to convey Canadian oil sands production to US refineries in the Southern Gulf states. This Executive Order exemplifies the administration’s stance toward the fossil fuel industry and has directly, negatively impacted US output.

In the face of rapid price increases for end products such as gasoline, Mr. Biden has called upon OPEC to increase its production and for domestic producers to “help bring down prices.”[3]

After immediately restricting energy production in January, during a recovery heavily dependent on abundant, cheap fuel, the President now seems to acknowledge an error by imploring producers to..... produce more.

Neither exhortation has been effective. OPEC has simply refused to help and on the domestic front, jawboning will have little influence on free-market forces reflecting strong demand and diminishing supplies. Only more production will correct the imbalance propelling crude and myriad related prices higher.

The thrust of the administration’s solution to skyrocketing fuel prices, then, is to “…address anti-competitive practices in U.S. and global energy markets to ensure reliable and stable energy markets," a White House official said.[4]

The peak value on the above chart is 13.1 million barrels/per day in late February 2020. The value as of October 8, is 11.4 million/day. That better than 12% decline, coupled with surging demand as the economy attempts to fully reopen means that not only are supplies tightening, but also that the US must now import more crude from OPEC, Russia, et. al.

The solution to this problem is self-evident but the administration’s economic philosophy does not provide for supply stimulation. Consumers have been flooded with payouts from the Treasury over the past 18 months, a flow of funds bolstering the wrong side of the economic equation if non-inflationary growth is a goal.

For energy prices to stabilize or retreat, the supply of oil must be increased and, for US consumers, the best method to accomplish that end would be to relax the rhetoric condemning fossil fuels and to allow domestic oil producers to begin re-filling the figurative pipeline.

Current pricing trends epitomize the fallacy in Democrats’ economic programs. Promoting consumption without corresponding stimulation of production is a recipe for inflation. Consumers experience the results with every visit to the gas pump or food store. There is precious little in any pending legislation that will contribute to growth by helping to augment supply in the economy.

Unfortunately, the administration remains tone-deaf on this issue, which will only mean further inflation during the winter and Holiday Season. The US is fast approaching the point at which inflation will only be conquered by higher interest rates and supply-side stimulation. The good news is that equities historically have proven the most effective means to maintain purchasing power, regardless of the rate of inflation.

Robust earnings across the board could propel equity benchmarks to new highs over the coming weeks, despite rising interest rates, and despite a lack of focus in the administration on viable, proven solutions to counter accelerating inflation. Regardless, markets will continue to function efficiently, effectively discounting the impact of current events on future equity returns.

Byron A. Sanders

Investment Strategist

[1] “JPMORGAN CHASE REPORTS THIRD-QUARTER 2021 NET INCOME OF $11.7 BILLION ($3.74 PER SHARE),” www.jpmorganchase.com, October 13, 2021.

[2] “US heating bills set to spike this winter thanks to inflation, feds say,” www.nypost.com, October 14, 2021.

[3] “White House asks U.S. oil-and-gas companies to help lower fuel costs -sources,” www.reuters.com, October 13, 2021.

[4] Ibid.