Back and forth action earlier this month gave way to a steady downtrend over the last two weeks, culminating, so far, in a roughly 3% across the board global equity selloff October 28.

Markets are discounting negative impact from another round of economic lockdowns as numerous EU countries reinstate quarantines amid surging new cases of the Covid‐19 virus.

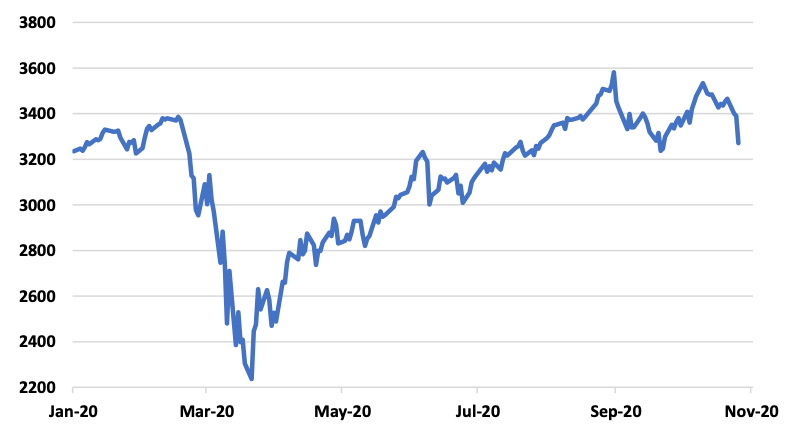

Since its most recent peak on October 12, the S&P 500 has declined 7.4% through yesterday’s close. Most other broad domestic indexes have posted similar losses but remain above their late September lows. Barely. The narrower but widely followed Dow Jones Industrial and Transportation Averages ended Wednesday below their comparable September lows. Closing prices for the S&P 500 since December 31, 2019 are below.

Source: Quotestream online quotation platform, www.quotemedia.com

Congress’ failure to reach a compromise on a new round of spending to offset the spring and summer economic contraction is also shouldering the blame for market jitters. In addition to individual hardships from job losses, state and local governments have been feeling the pinch of diminished tax revenues from businesses either shut down or shuttered permanently.

Further direct aid beyond the hundreds of billions distributed to state governments in previous bills has been a contentious point in negotiations between the House, the Senate, and the White House. Various estimates of the gap existing in this area of the potential legislation since the House passed its $2.6 trillion bill in late May have ranged from $500‐$600 billion.(1) There have been hopeful noises from ongoing talks between Speaker Pelosi and Treasury Secretary Mnuchin but no meeting of the minds has been reached. The reality of election politics has reinforced public rancor on both sides. It is likely to be too heavy a lift for ideologies on either side of the aisle to give opponents “a win” this close to Election Day.

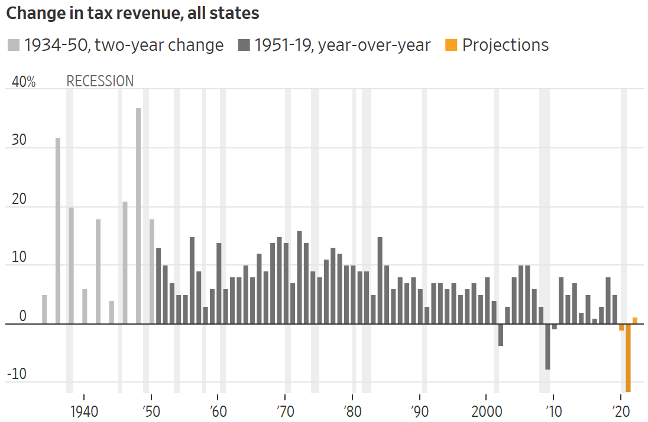

Nonetheless, the pain is real and tangible for many states. The chart below details the change in tax revenues of all states for the periods indicated.

Reprinted by permission, www.wsj.com, October 29, 2020

Note that the figures for 2020, 2021 and 2022 (in color) assume no new stimulus money. There are similarly, no new lockdowns anticipated, which if they occur, would exacerbate projected 2021 shortfalls.

There are two solutions possible to this situation. One is to appropriate additional state bail out funds, the other is to fully reopen the country and to let the economy begin to restore tax revenues. Obviously, middle ground exists between the two extremes, but finding it, so far, has been elusive.

Which brings us back to Covid‐19.

France and Germany have joined Italy and Spain in new rounds of national contact restrictions, attempting to stem a “very alarming”(2) increase in virus infections. The measures are currently scheduled to expire in a month’s time however, the economic damage will likely not be insignificant.(3) European bourses reflected growing anxiety with better than 3% plunges yesterday morning, leading Wall Street lower.

But as we’ve noted multiple times, a case of Covid‐19 is not an inevitable death sentence. Advances in treatment methods and discovery of effective therapeutics have dramatically increased recovery percentages since February and March. The media concentrate on infection rates but we believe the more important statistic is likelihood of survival. The data below from the CDC reports the US survival rate by age group as of early August, the most recent information (released 9/20).

CDC COVID‐19 Survival Rates (4)

Age 0‐19 — 99.997%

Age 20‐49 — 99.98%

Age 50‐69 — 99.5%

Age 70+ — 94.6%

We make no attempt to minimize any death from this disease, but the fact is that an overwhelming percentage of the US population will not succumb to a case of Covid‐19, even in the highest risk age group.

But what about the rest of the world?

The US has arguably the best or certainly one of the best healthcare systems on the planet so are we an island in a sea of far greater Covid‐related fatality risk elsewhere?

The New York Times has been keeping track of global Covid‐19 data and publishes a frequently updated table of mortality rates by country. The table and other pertinent information can be found at, www.nytimes.com/interactive/2020/world/coronavirus‐maps. It is worth a look.

Today’s update identifies two countries with reported death rates greater than 1/100,000 population and six additional with rates over 0.5/100,000. Except for a handful of the 216 countries(5) reporting Covid‐19 cases, attributed fatality rate is 1/200,000 or less. The current US rate is 0.2/100,000 (1/500,000).

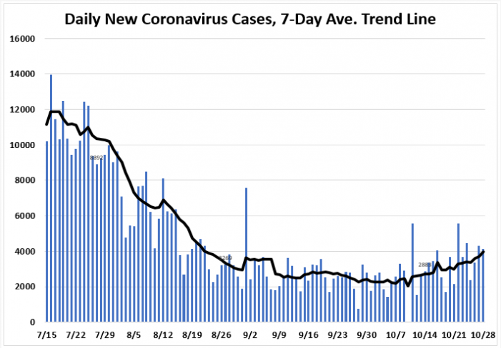

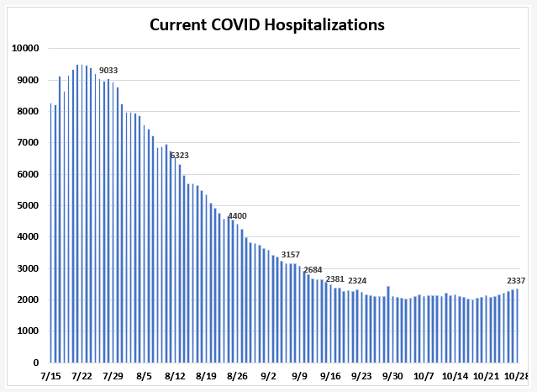

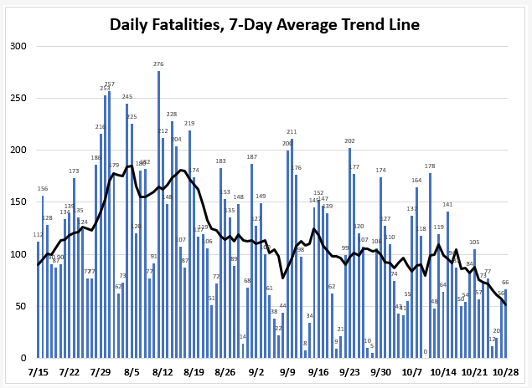

This is the situation in Florida. (6)

If one is concerned by the increase in new US Covid‐19 cases, these charts may be reassuring. There is, of course, a lag between infection and a potential fatality, but the disparity between the first and third charts confirms that the risk of death from Covid‐19 is declining in Florida. Trumpeting new infections sells, so relevant survival statistics are usually not prominent in press accounts.

We’re reaching the end of election season and polls continue their expected tightening. In fact, several national polls by reputable firms that called Mr. Trump’s victory in 2016 are now showing the President with a narrow lead, which is a statistical dead heat.

The largest question outside of who will eventually triumph, is how long the country will have to wait before a new President and Congress are recognized. The Supreme Court has already decided to let stand several lower court decisions extending windows for accepting ballots beyond Election Day but has left open the possibility of revisiting the cases after the election. (7)

The Constitution gives sole, unambiguous authority to state legislatures to establish election procedures. Deferring decisions on the merits of cases in which courts have modified state legislative rules may be an attempt to avoid influencing the election before the fact.

In our view, the greatest obstacle markets face, other than the outcome of the US elections, is to evaluate the global economic impact of new EU Covid‐19 countermeasures. Anxiety and fear in the EU and individual country governing authorities suggests lower prices, at least in Europe, as investors gauge the impact of more economic suppression.

In the US, several states that have been slow to reopen, could respond to rising infection rates with new limitations. The President, conversely, has made clear that he does not expect new national mandates, which may compartmentalize economic damage.

Worst case scenarios were afforded great credence in February and March, but never really materialized. Data, accelerated vaccine development, and more effective treatment protocols suggest a conclusion that the US has registered remarkable progress overcoming Covid‐19 as an immediate health threat.

Byron A. Sanders

Investment Strategist

(1) “Aid for state, local governments a sticking point in federal COVID‐19 relief,” www.marketplace.org, October 6, 2020.

(2) “EU unlocks €100 million for COVID‐19 tests to fight 'very alarming' rise in infections,” www.euronews.com, October 28, 2020.

(3) “France and Germany Lock Down as Second Coronavirus Wave Grows,” www.nytimes.com, October 29 2020.

(4) Data compiled from multiple sources by the Center for Disease Control and Disease Prevention, www.cdc.gov, September 20, 2020.

(5) “Countries where COVID‐19 has spread,” www.worldometers.info/coronavirus, October 29, 2020.

(6) All information in these charts is courtesy of the Florida Dept. of Health, posted at www.tallahasseereports.com

(7) “Supreme Court Allows Longer Deadlines for Absentee Ballots in Pennsylvania and North Carolina,” www.nytimes.com, October 28, 2020.

©2020 Artifex Financial Group LLC