Confusion in Washington?

June 29, 2021

Equity market volatility returned in the second half of June. Benchmarks experienced several steep selloffs and recoveries during the period, but by late in the month net movement for most popular indexes over the two weeks was roughly 1% positive. Investors initially reacted unfavorably to news that the Fed could advance its tightening schedule by months, only to see prices more than recoup all losses and more the following day.

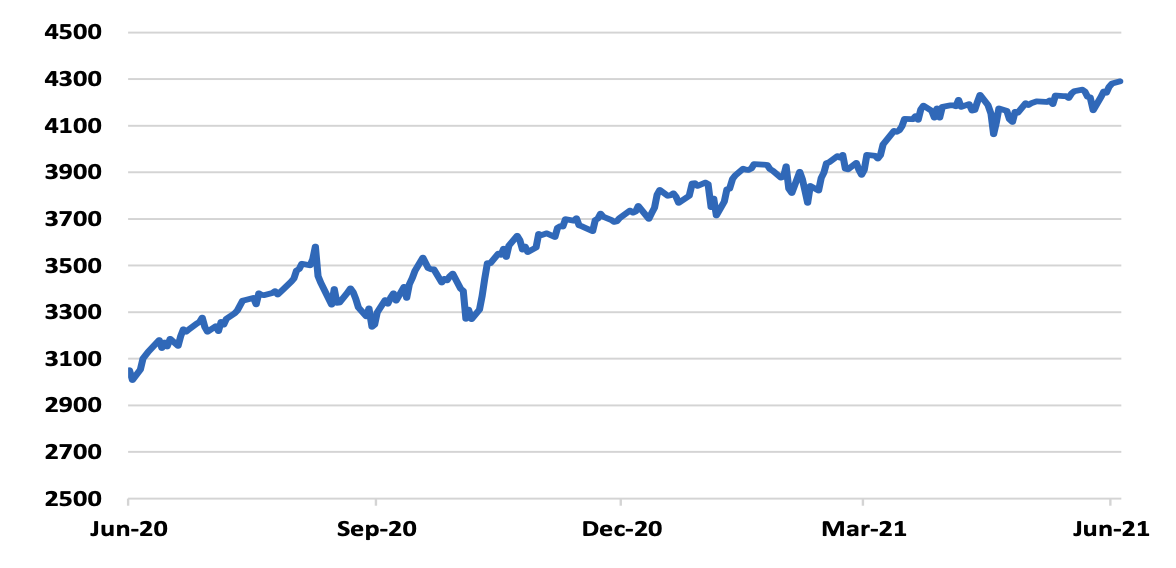

Stocks have continued to work on balance higher in June. International markets have kept pace, and all signs point to accelerating recovery from Covid-19 shutdowns in virtually every corner of the globe. Equity progress in the US has persisted despite periodic declines as recent inflationary upticks keep alive the prospect of unforeseen, preemptive action by the Fed. Closing prices for the S&P 500 over the 12 months ended June 28th are illustrated below.

Source: Quotestream online quotation platform, www.quotemedia.com

All eyes have been on Washington recently, focused on negotiations between the White House and a bipartisan group of moderate Senators attempting to hammer out a smaller, more targeted version of the President’s infrastructure legislation.

The talks yielded apparent agreement to reduce Mr. Biden’s proposed $2.2 trillion appropriation to roughly $1 trillion and to use previously appropriated funds for the bulk of outlays, a significant retreat from the President’s original intent to use all new spending.[1] Most observers expected the compromise to be sent to Congress and to provide a framework for defining the scope of infrastructure spending. President Biden and the negotiators met with the press to announce success.

However, a wrench was thrown into the celebrations almost immediately. The President declared the following day that the modified terms would not be honored unless Progressive priorities in the original legislation were passed simultaneously.[2]

Mrs. Pelosi similarly indicated no possibility of the House adopting the compromise unless all original outlays and programs are presented in a contemporaneous bill.

Clearly, this stipulation from Democrats stunned Republicans. It was not understood to be a component of the deal. The compromise is reduced to an exercise in futility by these demands.

Following Republican outrage citing bad faith, the President walked back his comments and seemed to abandon tying the compromise bill to the adoption of the broader Democrat agenda.[3] Confusing? Yes.

Spending restraint is Republicans’ goal, but Democrats could alternately use reconciliation to accomplish their aims, which requires only a simple majority. The 60 vote filibuster does not stymie reconciliation.

Republican negotiators appear to have walked into a trap. They succeeded in reducing new spending in a bipartisan infrastructure bill, but Democrats remain determined to appropriate the previous trillions, regardless of Mr. Biden’s third-day assertion he remains committed to passing the compromise without conditions.[4]

Markets appear more interested in remarks from the Federal Reserve than from Congress, in view of recent performance. Future rate hikes concern investors more than undefined, unrestrained spending if index gyrations the past two weeks are any indication.

During the week ending June 18, Mr. Powell and Fed Governor Bullard (not on the policy-setting Open Market Committee), separately announced possible rate hikes in late 2022 or early 2023 instead of “late” 2023. This horizon is so broad it hardly bears consideration given the potential market influencing events that could occur in the interim.

Bond prices registered faint reaction to the gentlemen’s comments, but ultimately will render judgment of Fed actions. Whether due to Fed bond purchases or inflation skepticism, Treasury yields have traded in a narrow range this quarter and actually declined after Powell’s statement. Actions are simply too far in the future to impact near term economic events.

We occasionally pick on the press and recent volatility has generously provided another example of a reflex toward recency in most market analyses.

On Friday June 18th, the Dow plunged more than 500 points after Fed Governor Bullard stated his belief that tightening will begin in late 2022. Here is part of that evening’s market comment from The Wall Street Journal:

“U.S. stocks retreated Friday, as traders warily eyed the Federal Reserve for hints of where monetary policy is headed…Policymakers had signaled Wednesday that they expect to raise interest rates by late 2023, sooner than they had previously anticipated. Sentiment waned again on Friday after Federal Reserve Bank of St. Louis leader James Bullard said on CNBC that he expects the first rate increase even sooner, in late 2022.”[5]

The following Monday, June 21, markets soared, more than erasing Friday’s losses. From the same newspaper that evening:

“U.S. stocks rallied Monday, lifting the Dow Jones Industrial Average by more than 550 points…Monday’s moves marked a comeback for stocks after investor anxieties about the Federal Reserve’s path for monetary policy sent the Dow on its biggest decline since late October. Initial worries centered around Fed officials signaling they may raise interest rates sooner than anticipated… Investors who are optimistic…say that faster growth and inflation in the coming months are likely to support the market overall—even if long-term rates rise slightly.”[6]

So, in the space of a weekend, investor interest rate anxieties cooled, replaced by focus on the growing economy. Such is the futility of attempting to identify the cause of day-to-day market action. One day fear, the next, optimism. Fortunately, economies don’t reverse as rapidly….

In our view, what happens in Washington D C. over the next several months will be as important as what the Fed does or does not do next year. Democrats are not shelving their ambition to reorder citizens’ incentives to align with their vision, but unforeseen changes in monetary policy (e. g., a quicker tightening) could torpedo their spending scenarios by eliminating the Fed’s acquiescence with monetizing deficits.

Reconciliation remains in Senate Majority Leader Schumer’s toolbox and barring defection by any in his caucus, we expect him to use it. Moderates in both parties have expressed reservations at trillions in new spending and draconian tax increases, but Mr. Schumer is diving into the breach, seemingly oblivious to even Democrat dissenters.

Bonds and the dollar will react when deficit spending passes a tipping point in investor estimation. As long as these key markets remain calm, we expect the economy to continue expansion and equity prices to move irregularly higher.

Byron A. Sanders

Investment Strategist

[1] “Biden, Senators Agree to Roughly $1 Trillion Infrastructure Plan,” www.wsj.com, June 24, 2021.

[2] “Instant Bipartisan Double Cross,” www.wsj.com, June 24, 2021.

[3] “Biden Walks Back Threat on Bipartisan Infrastructure Deal,” www.wsj.com, June 26, 2021.

[4] “GOP is being fooled by this infrastructure ‘deal’,’ www.nypost.com, June 24, 2021.

[5] “Dow Falls More Than 500 Points,” www.wsj.com, June 18, 2021.

[6] “Stocks Rebound as Dow Gains More Than 550 Points,” www.wsj.com, June 21, 2021.