Reopening

May 18, 2020

Global equity markets moved irregularly but moderately higher during the first half of May. Rallies and declines have hinged on momentary bits of news, including some better than expected first quarter earnings reports. But progress has been limited.

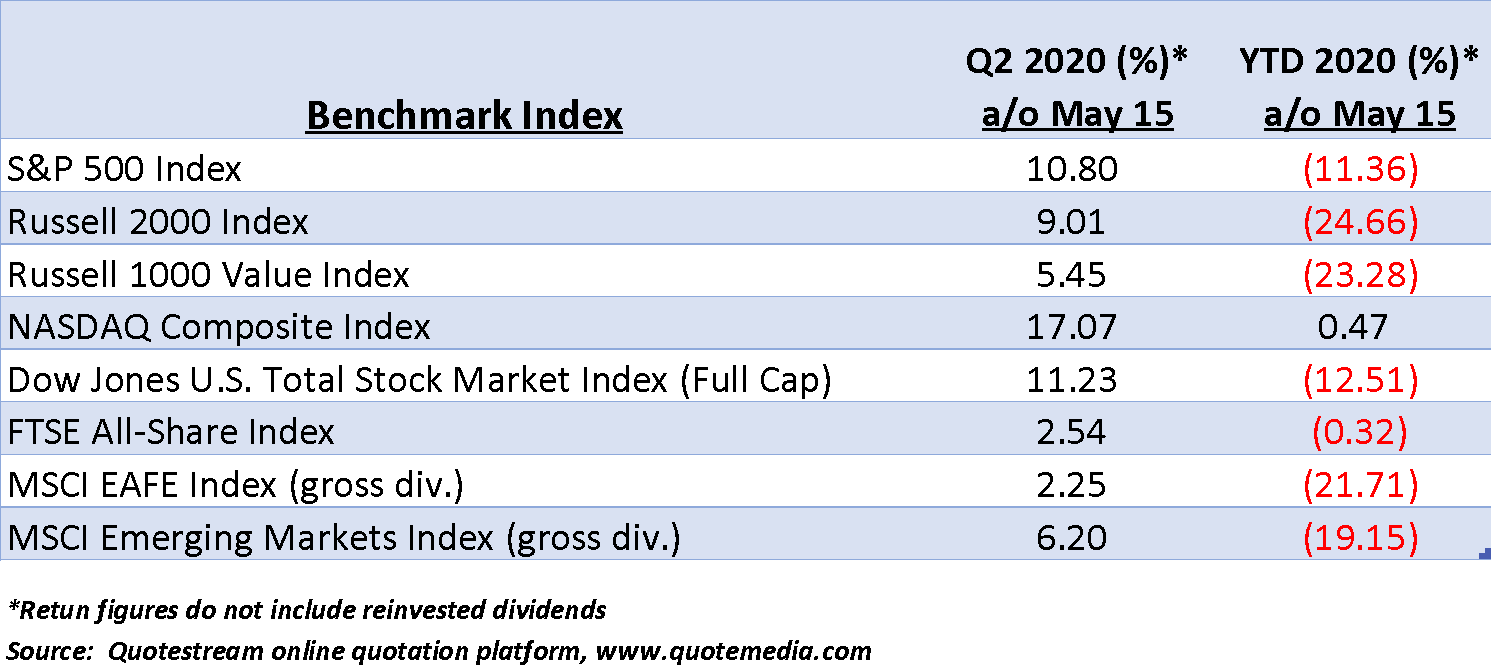

The most important news, however, has been emanating from states that have engaged in tentative, first step relaxations of stay at home orders. Texas, Florida, and Georgia, particularly, have been the focus of national attention. To date, there has been no significant reversal of the downward trajectory of infection rates that were the predicates for governors to allow high contact businesses such as restaurants, barbershops, and beauty salons to begin partial resumption of activity.[1] Growing optimism that the worst has passed for Coronavirus is emerging in the markets. Price changes for key indexes through May 15 and for the YTD are below.

April’s strong performance stands virtually intact after two weeks of trading this month. The most notable number in the chart is the NASDAQ Composite, which as of the 15th had erased its entire February/March decline and moved into nominally positive territory for the year. Big Tech stocks have in many ways prospered from the shutdown as virtual contact for individuals, businesses and schools has become de rigueur. Technology is leading not only the markets but also the economy back from the brink.

Federal Reserve Chairman Jerome Powell has been relatively vocal recently. In speeches and interviews, the Chairman has made no effort to portray the next few months as anything other than painful.[2] His comments reinforce the analysis we published last month from Edward Lazear, former Chairman of President G.W. Bush’s Council of Economic Advisors. Both men expect a gradual recovery that should extend well into 2021.[3]

Does this guarded outlook suggest equity markets are getting too far ahead of economic developments?

One of our constant themes is that equity markets reflect future expectations. In the context of 2020, the market recovery does not seem particularly overenthusiastic. Global equity prices remain significantly lower for the year despite domestic benchmark recoveries of 30%-50% from their worst levels, with the previously noted exception of the NASDAQ Composite.

At the March 23 lows, valuations for many US corporations had declined to levels not seen since the 2008-2009 bear market. Despite a general uptrend since those lows, many financially strong corporations are still priced at levels offering very high expected returns.

But what about the upcoming torrent of negative economic news?

Employment has disappeared for many Americans. Numerous small businesses lacking financial resources or cash reserves will likely fail. In an interview presented May 17, Mr. Powell stressed that we should expect “Depression-era numbers” from statistical economic reports over the next couple of months, at least.[4]

Rationally speaking, it is difficult to conceive of anyone left in the country (or world) that is unaware of the economic situation we face and further, that the next several rounds of monthly unemployment reports will show catastrophic job losses as well as steep declines in virtually any measure of economic activity.

But what if we focus on the converse of that outlook? Should we expect economic numbers more disastrous than have already been envisioned? Absent a new national outbreak of the COVID-19 virus, we believe the answer is, “No.”

This “situational awareness” for investors in conjunction with attractive valuation metrics, especially dividend yields, is likely fueling the optimism equity markets are expressing. Undeniably, the global economy will mend. The process is already underway.

We’ve talked often about the commodity markets and have been looking for price gains as early signals of an upturn in global economic activity. But not all price increases are positive. Pork and beef shortages are developing in the US because of virus related processing plant shutdowns. Futures prices for both have increased sharply in recent weeks. Anecdotal retail level information finds that pork prices per pound have more than doubled since mid-April, albeit from depressed levels. Supermarket beef prices have risen roughly 25%-30% over the same period.

Aside from these transient anomalies, which will disappear relatively quickly when plants fully reopen and the next generation of animals comes to market, many industrial commodities are in uptrends. WTI crude oil has rebounded to near $30/barrel in the face of ongoing significant oversupply, and gasoline futures are once again above $1/gallon, which represents a doubling from last month’s lows. But these moves are simply restoring markets to pre-Coronavirus levels and do not represent potentially inflationary pressure.

Copper has long been viewed as one of the best gauges of global economic activity. A developing recovery in China, which consumes roughly half the world’s industrial commodities, has helped to propel copper futures steadily higher since the end of the first quarter.[5] This is visible indication of a rebirth of global activity. Prices for near month copper futures over the past year are below.

Source: Quotestream online quotation platform, www.quotemedia.com

What is evident in the above chart is an increase in demand. Commodities do not pay dividends and academically speaking, offer no inherent expected return. Prices are pure reflections of supply and demand balances.

In our view, the copper recovery is “behind the scenes” evidence that a global recovery is in progress and confirms strength in the equity markets. It is very early days and a long road to previous highs remains, but clearly foundations exist for a belief that the worst pending economic numbers have been discounted by markets.

As more US states and other countries begin to resume a semblance of normality, markets are seeing a brightening future. The experience of states that have been partially reopened for more than two weeks is revealing that a resurgence of the virus has not materialized. Hotspots in the US remain but to date, the conditions in states that have recorded consistent declines in the rate of new infections have not been adversely affected by greater consumer contact levels.

Disappointments almost certainly lie ahead for the markets, but barring impetus for governments to reimpose lockdowns, it is reasonable to expect further upside progress from markets and a gradual but steadily accelerating resumption of economic interaction. Markets see into the future far better than individuals and what they appear to be seeing is increasingly encouraging.

Byron A. Sanders

Investment Strategist

©2020 Artifex Financial Group LLC

[1] Data provided by CDC and other Federal and State agencies.

[2] “Fed’s Jerome Powell Says Economy Faces Long, Uncertain Recovery,” www.wsj.com, May 17, 2020.

[3] Ibid.

[4] Ibid.

[5] “Copper Rebounds on Hopes for Economic Recovery,” www.wsj.com, May 8, 2020.