August 6, 2020

July extended a run of positive monthly returns since the end of the first quarter. A strong first half was followed by uneven performance during the late stages of the period, but overall, global equity prices forged higher for the fourth consecutive month.

As August approached, several broad domestic indexes bettered their early June recovery highs. These were in addition to the NASDAQ Comp’s ongoing progress into new all-time high territory. As we noted in our last blog post, a strong majority of earnings (and revenues) for the second quarter are surpassing expectations with tech giants leading the way. Q3 estimates are being revised higher.[1] [2]

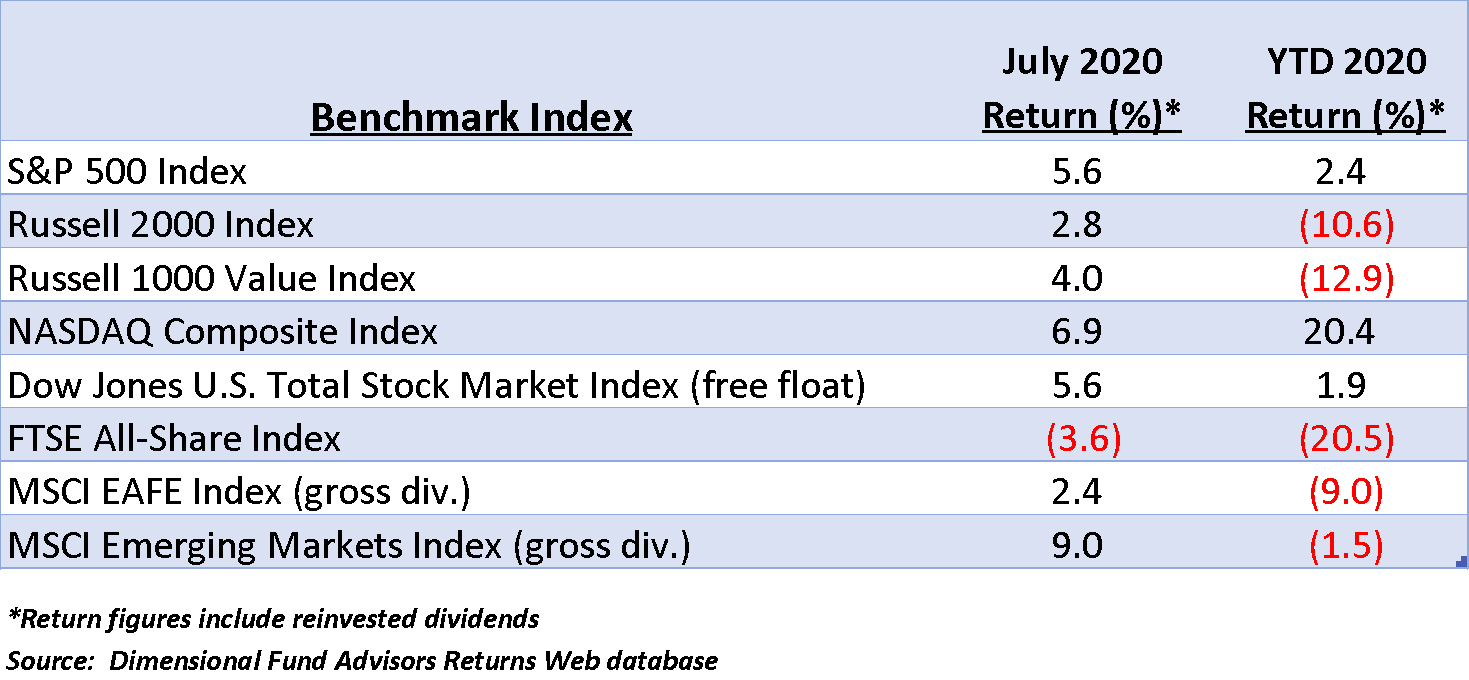

International and Emerging Market equities have participated in the ongoing upswing. In fact, the MSCI Emerging Markets Index closed within 1.5% of its 12/31/29 mark on July 31. Representative equity benchmark index performance for the first month of the third quarter and YTD are detailed in the chart below.

Yields in the US Treasury market have declined over the past 30 days despite clear indications that economic activity is reaccelerating. At its July meeting, the Federal Reserve reiterated an intention to continue purchasing a wide array of bonds.[3] The news led some short term interest rates into new low territory. There is little expectation of material upward movement in rates until and unless the Fed curtails or eliminates its asset acquisition program.

The first estimate of US second quarter GDP was released on July 30. The results were nominally better than expectations, posting an annualized decline of roughly 32%. Below is a quote from the Bureau of Economic Analysis press release:

The decline in second quarter GDP reflected the response to COVID-19, as "stay-at-home" orders issued in March and April were partially lifted in some areas of the country in May and June, and government pandemic assistance payments were distributed to households and businesses. This led to rapid shifts in activity, as businesses and schools continued remote work and consumers and businesses canceled, restricted, or redirected their spending. The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the second quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified.[4]

Equity and bond markets anticipated this magnitude of number last spring with a global equity plunge that bottomed on March 23. Market performance during the roughly six week period from mid-February to late March discounted Great Depression era economic statistics, which were confirmed in this report.

But since their lows in March, equities worldwide have moved steadily higher. In some cases (e.g., NASDAQ and Emerging Markets), sharply higher. Why the apparent disconnect from “economic reality?”

Steep declines frequently lead to equally steep recoveries, not only in markets, but also economies, if government “interference” is minimized. During the long recovery from the 2008-2009 crash, Congress and the Obama administration created layers of new regulations designed to prevent recurrences of the credit market meltdown and near collapse of the world’s banking system. Stringent banking system risk/lending constraints and draconian reserve requirements had outsized impacts on community banks, which was a major factor inhibiting a robust economic recovery.

To date, government response to the pandemic has been largely limited to providing liquidity to credit markets (Fed bond buying), loans to businesses (PPP) and conveying cash to individuals (Treasury payments and supplemental unemployment benefits). The natural tendency of the economy to rebound has not been shackled and markets have responded positively.

But we are approaching a crossroad.

Third quarter US GDP is estimated to increase anywhere from 15%-20+% on an annual basis,[5] reflecting not only ongoing cash infusions from Congress, but also reopening states/businesses. In recent weeks, however, new spikes in detected Covid-19 cases have prompted several states to pause.

Data continue to suggest that exposure to large group gatherings is the most frequent catalyst for new cases, in conjunction with expanded rates of testing. But the more important statistics remain hospitalizations due to the infection and deaths. Neither of these measures has increased to the degree of daily case detections.

Congress is deadlocked over a fourth round of stimulus spending, which would result in increases to the national debt ranging from $1 trillion to $3 trillion depending on which version is examined. This is the crossroad.

Previous bills have focused on direct payments, loans, additional unemployment benefits and funds for hospitals and schools. The current iteration of proposed spending goes well beyond these basic areas. Statements by Congressional leaders and the Administration suggest less than certainty that an agreement can be reached.[6]

There appears to be agreement on additional direct payments to individuals and an extension of supplemental unemployment benefits. Adding to uncertainty is that schools may or may not open this fall, which could prevent some workers’ return to their jobs.

Not surprisingly, political considerations and tactics are fueling the conflict. House Democrats have proposed an expanded scope of outlays in their bill while Senate Republicans are balking at non-Covid-19 related spending.[7]

It is conceivable no compromise will emerge, and competing proposals languish in Congress. Both parties would then attempt to capitalize on the impasse. Democrats will characterize Republicans as insensitive to the country’s pressing needs and Republicans will portray Democrats as promoters of superfluous spending under cover of pandemic relief. Should no bill emerge that the President endorses, the November elections will likely pivot on these competing views.

For markets, the key question surrounding debt is whether and how much capital taxes will extract from citizens’ pockets and the economy. Mr. Biden’s unequivocal position is that he would propose tax increases estimated at $4 trillion by repealing the Trump cuts.[8] The President is advocating cuts, including a payroll tax holiday as part of any new Covid-19 relief bill.[9]

To date, the equity recovery has recouped a huge percentage of spring’s losses, led by tech companies that have benefited from stay at home requirements. Higher taxes could easily puncture the equity rally and stifle the economy’s nascent recovery.

Patient investors have been rewarded, but markets could turn dicey as November nears and polls narrow. We continue to believe that the foundation for a strong economic recovery exists. By 2021, in the absence of dramatic changes in fiscal or tax policy, statistical indicators have the potential to report cumulative net expansion since the end of 2019.

Byron A. Sanders

Investment Strategist

©2020 Artifex Financial Group LLC

[1] “S&P 500 Earnings Season Update: July 31, 2020,” www.insight.factset.com, July 31, 2020.

[2] “Analysts Are Raising Quarterly S&P 500 EPS Estimates for the First Time Since Q1 2018,” www.insight.factset.com, August 3, 2020.

[3] Federal Open Market Committee: “July 28-29, 2020 FOMC Meeting,” www.federalreserve.gov, July 29, 2020.

[4] “Gross Domestic Product, 2nd Quarter 2020 (Advance Estimate) and Annual Update. www.bea.gov, July 30, 2020.

[5] “GDPnow,”www.frbatlanta.org/cqer/research/gdpnow.

[6] “Meadows says he's "not optimistic" deal on coronavirus relief will be reached in near future,” www.cbsnew.com, August 3, 2020.

[7] “McConnell makes opposition clear to FBI building money in next stimulus,” www.cnn.com, July 28, 2020.

[8] “Joe Biden is teaming up with Bernie Sanders to raise taxes—here’s the plan,” www.fortune.com, July 14, 2020.

[9] “The White House is doubling down on Trump's proposed payroll-tax cut, even amid weak support from Senate Republicans,” www.businessinsider.com, July 21, 2020.