Consolidation

December 16, 2020

Since the end of November, world equity prices have trended moderately higher. Several leading, broad based equity indexes in the US have scored new all-time highs but the intensity of activity has moderated noticeably. Lagging sectors are beginning to participate and broaden the rally but overall progress so far this month has been muted.

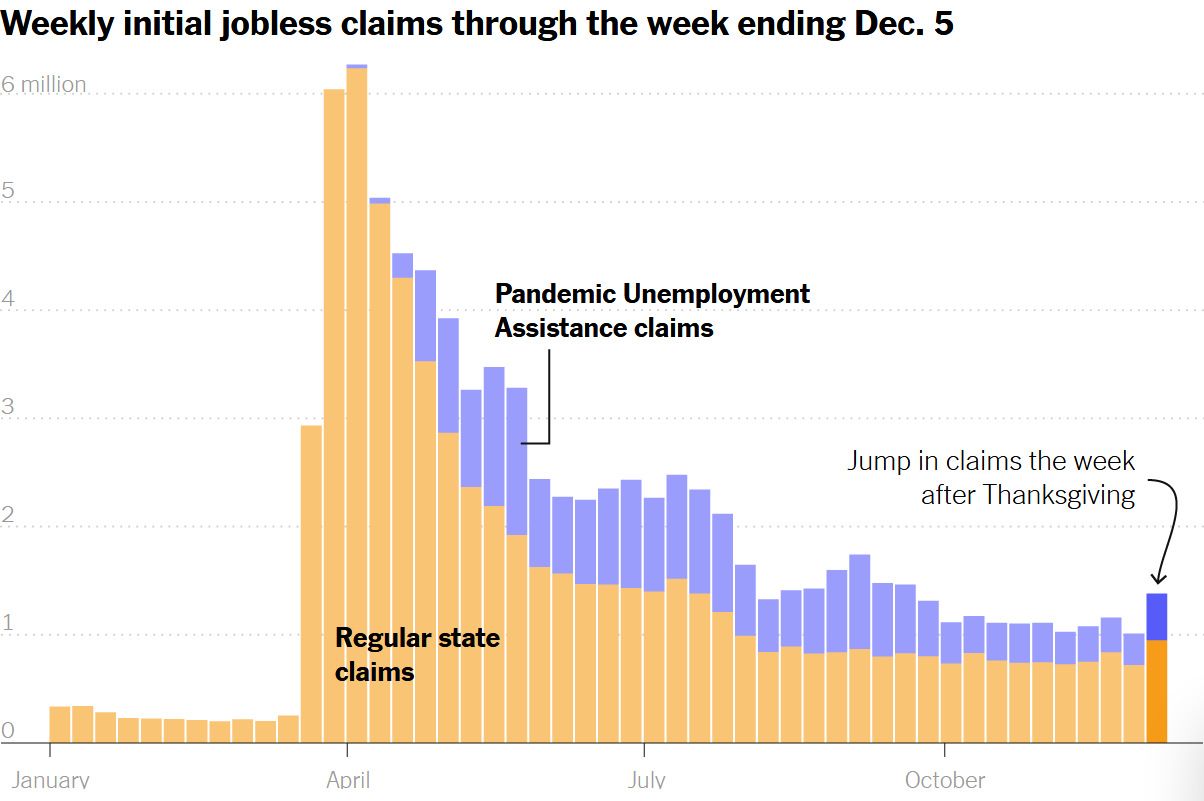

Economic data, especially on the employment front, has similarly paused its recovery to a degree. Several states, notably California, New Jersey, and New York, are proposing or have already implemented new blanket lockdowns to counter a “third wave” of Covid-19 cases. These measures will undoubtedly have negative impact on national employment statistics.

Mirroring the moderation of employment gains, the Commerce Department reported today that retail sales declined 1.1% in November, the first drop in seven months.[1]

The most recent data for weekly new unemployment insurance claims including pandemic-related assistance payment claims (in purple) during 2020 are illustrated below.

Source: US Department of Labor, www.dol.gov

Distribution of the Pfizer (NYSE-PFE) Covid-19 vaccine to high risk groups began this week and FDA approval for a Moderna (OTC-MRNA) version with better efficacy (95% vs. 90%) and less stringent storage requirements is expected within a week. Nonetheless, mayors in NYC, Los Angeles and elsewhere are either contemplating, or have already instituted, draconian measures restricting personal contact, travel, shopping, and dining out.

Effective vaccines are a light at the end of the tunnel, but under what conditions the new lockdowns will be reversed and a resumption of more normal life permitted in these areas remains unclear.

As much as the short term economic outlook is clouded by purposeful constraints, a longer term view remains positive and strong. Global activity, particularly in the Far East and China, has proved remarkably resilient with Emerging Markets among the best performing equity classes for the year.

Of course, these notoriously volatile markets can change course “on a dime” but recovery from the spring meltdown has been impressive with the MSCI Emerging Markets Index posting a YTD gain of 12.1% through December 15.

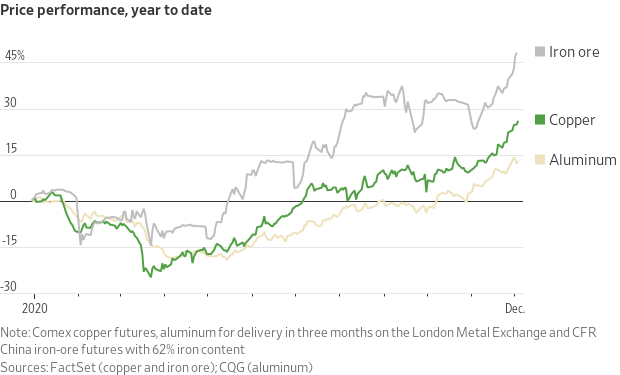

A by-product and confirmation of ongoing global recovery is manufacturing activity. Statistics vary widely from country to country and region to region, but one strong and historically reliable leading indicator is commodity prices, which have been in a persistent uptrend since the April economic trough.

Industrial metals are leading the way as China and other Far East manufacturing and export based economies ramp up from deep recessions. The chart below shows the performance of three important raw materials since the beginning of 2020.

One or more of these metals is a component building block for virtually every manufactured or constructed product from houses to electric vehicles. Iron ore is the base requirement for steel production and aluminum is ubiquitous in products from cookware to automobile engines. China typically accounts for roughly 50% of demand for world copper production, which has fueled a run to levels for that element not seen since early 2013 as China’s economy recovers. This chart is not one that would lead to a conclusion the global economy is on the verge of faltering.

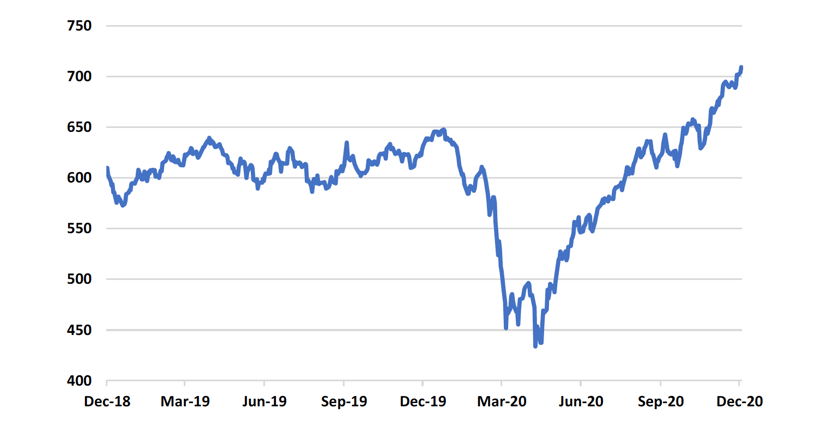

Similarly, a reduction in trade tensions between the US and China, including large purchases of US “soft” commodities such as grains and meats is reflected in the Dow Jones Commodity index, which tracks a basket of raw materials and other commodities. A two year chart of this index, which is posting all-time highs, is below.

Source: Quotestream online quotation platform, www.quotemedia.com

It is interesting to observe that at the late April low on the above chart, the index remained above its all-time low posted in mid-January 2016. The prolonged rise in this index suggests that a steady increase in global manufacturing activity and consumer consumption can reasonably be expected over the course of 2021.

After nearly two years of intense political activity, the 2020 Presidential Election concluded December 14th with the formalization of results in the Electoral College. The Biden/Harris administration will be inaugurated next month supported by a narrow Democrat House majority and potentially a single vote margin in the Senate with VP Harris as the deciding vote in what could be a 50-50 chamber.

Georgia’s two runoffs January 5 remain the lone unresolved elections. The balance of power in the Senate is up for grabs and the results of Georgia’s vote will determine whether the US has divided or unified government for the next two years, at least. Both Republicans are favored to retain their seats and maintain a Republican Senate majority, but polls are tight and both sides worry that election “fatigue” may inhibit turnout.

This year has produced a multitude of historic events and investors who remained patient through the challenging spring have been rewarded with a recovery that has occurred far more rapidly than the most optimistic predictions.

As we approach 2021, in the domestic equity markets, much will initially depend on the ultimate makeup of Congress. Democrats’ stated policy priorities include reducing domestic fossil fuel production in favor of renewable energy, higher corporate and personal tax rates, and potential reorganizations of the Supreme Court and the Senate.

We don’t like to make predictions, but it is difficult to imagine a lack of response from investors should the above policies be enacted. However, in our view, any reactions would likely be swift and limited in duration if not magnitude. The underlying expansion underway in the global and domestic economies is a strong underpinning for equities that can be expected to support a resumed uptrend once the impact of any new economic and/or regulatory initiatives have been fully evaluated and discounted in prices.

We want to wish all our readers and clients a very happy Holiday Season and send our fervent wishes for a Happy and Prosperous New Year. The confidence and support we have received, during a very trying year for all, is greatly appreciated. We look forward to the world putting the Covid-19 pandemic behind it and salute those who have sacrificed so greatly to ensure the survival of so many afflicted by the disease.

Be well!

Byron A. Sanders

Investment Strategist

©2020 Artifex Financial Group LLC

[1] “U.S. Retail Sales Fell 1.1% in November,” www.wsj.com, December 16, 2020.