April Market Commentary

May 5, 2022

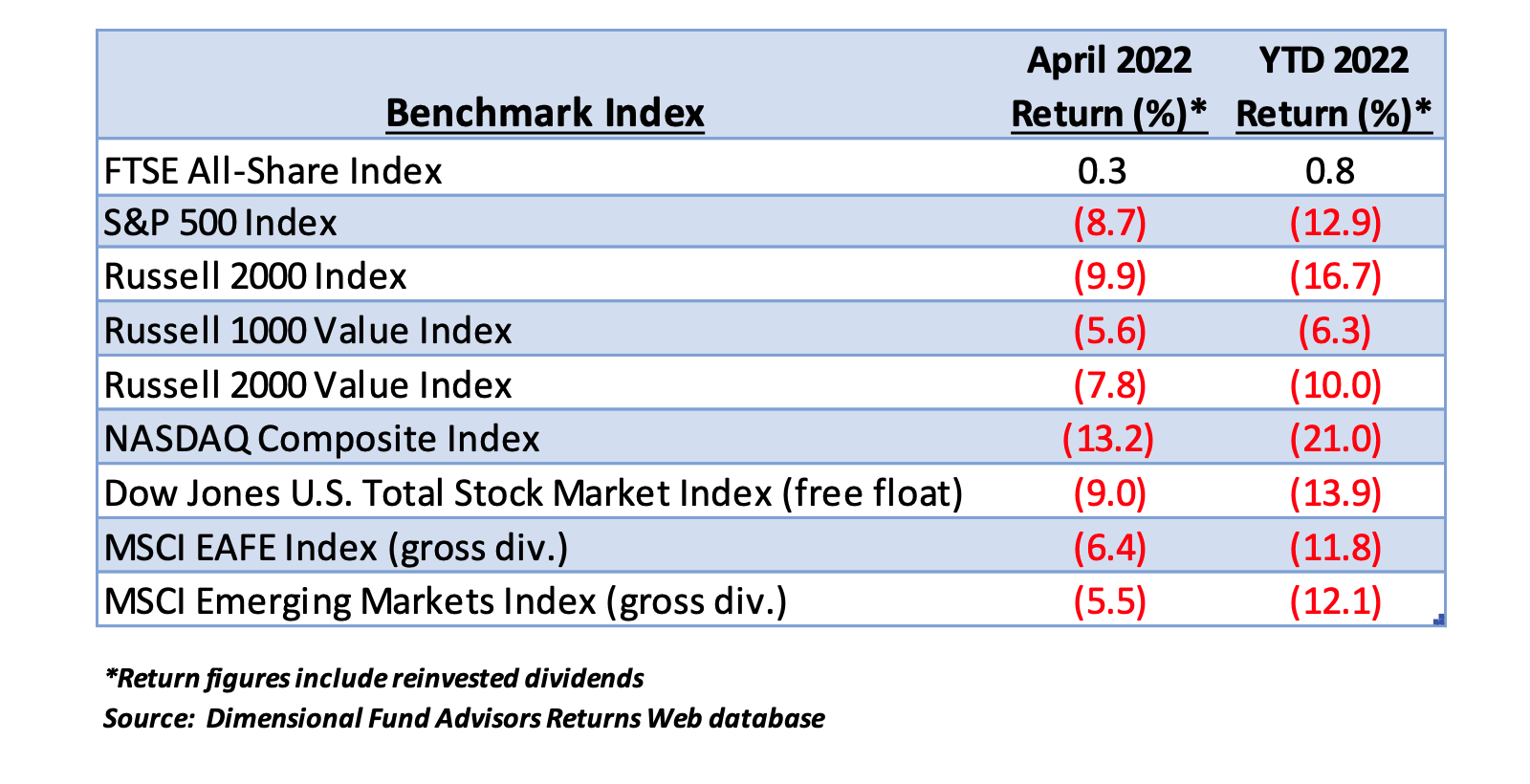

Global equity markets extended 2022’s persistent declines in April. Sharp losses were posted by most benchmarks, with the sole exception among our key indicators the FTSE All-Shares index, which eked out a nominal gain and remains in plus territory for the year.

Apparently, the implementation of Brexit and the ensuing divorce from EU constraints has allowed the British economy to avoid the growth slowdown evident in European capitals. Escape from the regulatory heavy EU bureaucratic regime is proving to be a benefit to Britons rather than the disaster predicted by those who had fiercely lobbied to remain in the European Union.

In the US, the NASDAQ Composite continues to lead on the downside. High tech and online retailing companies with strong revenues but sketchy profit numbers are being punished by investors as increasingly familiar violent reactions to disappointing earnings reports have begun to proliferate in the wake of first-quarter numbers.

Amazon’s (OTC – AMZN) release of revenue and earnings fell short of estimates for the January – March quarter and led to an immediate share price decline of better than 14% the following day. Subsequent performance has extended that decline. Investors are demanding lower P/E multiples for this and other former market leaders, which has been manifested in declining share prices. Performance of key global equity benchmarks for April and the YTD is below.

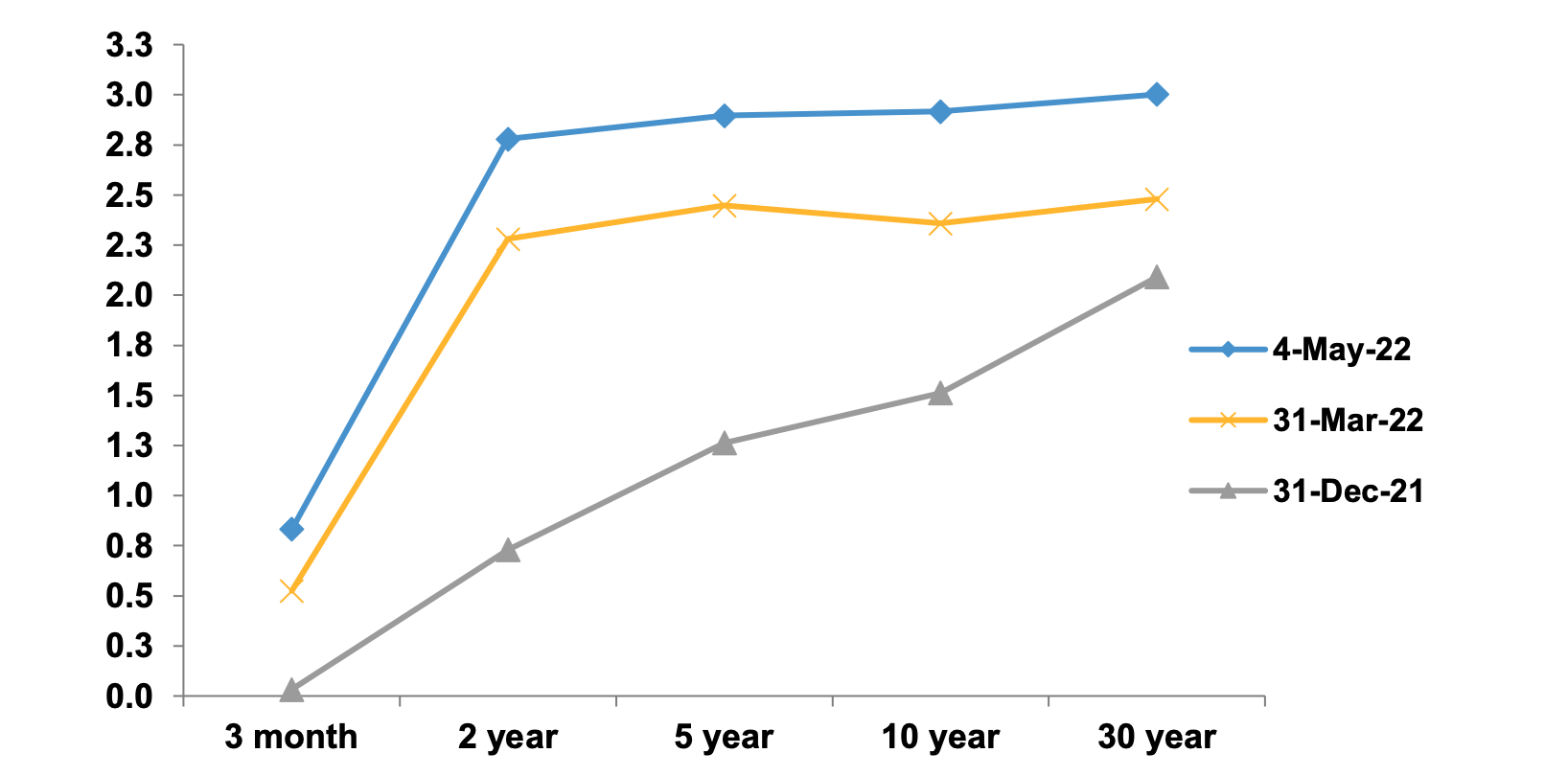

Bond prices remained locked in a steep downtrend during the month, with yields in the US Treasury market clustered just under 3% at the five, ten, and thirty-year maturities as April ended. The upturn in yields has been substantial since the end of 2021, and since March 31, as illustrated below.

Source: Quotestream online quotation platform, www.quotemedia.com

May 4th brought the expected .50% Fed Funds increase from the Fed. However, Mr. Powell’s remarks following the announcement took on a decidedly more “dovish” tone as he indicated that the Fed will likely not follow through with the far more aggressive language he expressed just last week and will begin only a modest reduction in its balance sheet assets in early summer.[1]

The apparent shift in policy sparked a massive short-covering rally in both the bond and stock markets, mirroring the declines last week when investors had expressed fears that a recession would result from overly aggressive tightening. We suspect an attempt to engineer a near-mythical “soft landing” will only lead to extended periods of inflation. Increasing rates to far closer or above the inflation rate has historically been the only effective means to quash rising prices and Mr. Powell has indicated this is not the course that will be pursued at this time.[2]

The Fed will need some assistance from a slowing economy if it is to avoid overreaching and strangle growth into recession. And, in fact, there are some signs that a slowdown is developing in one arena essential to economic expansion.

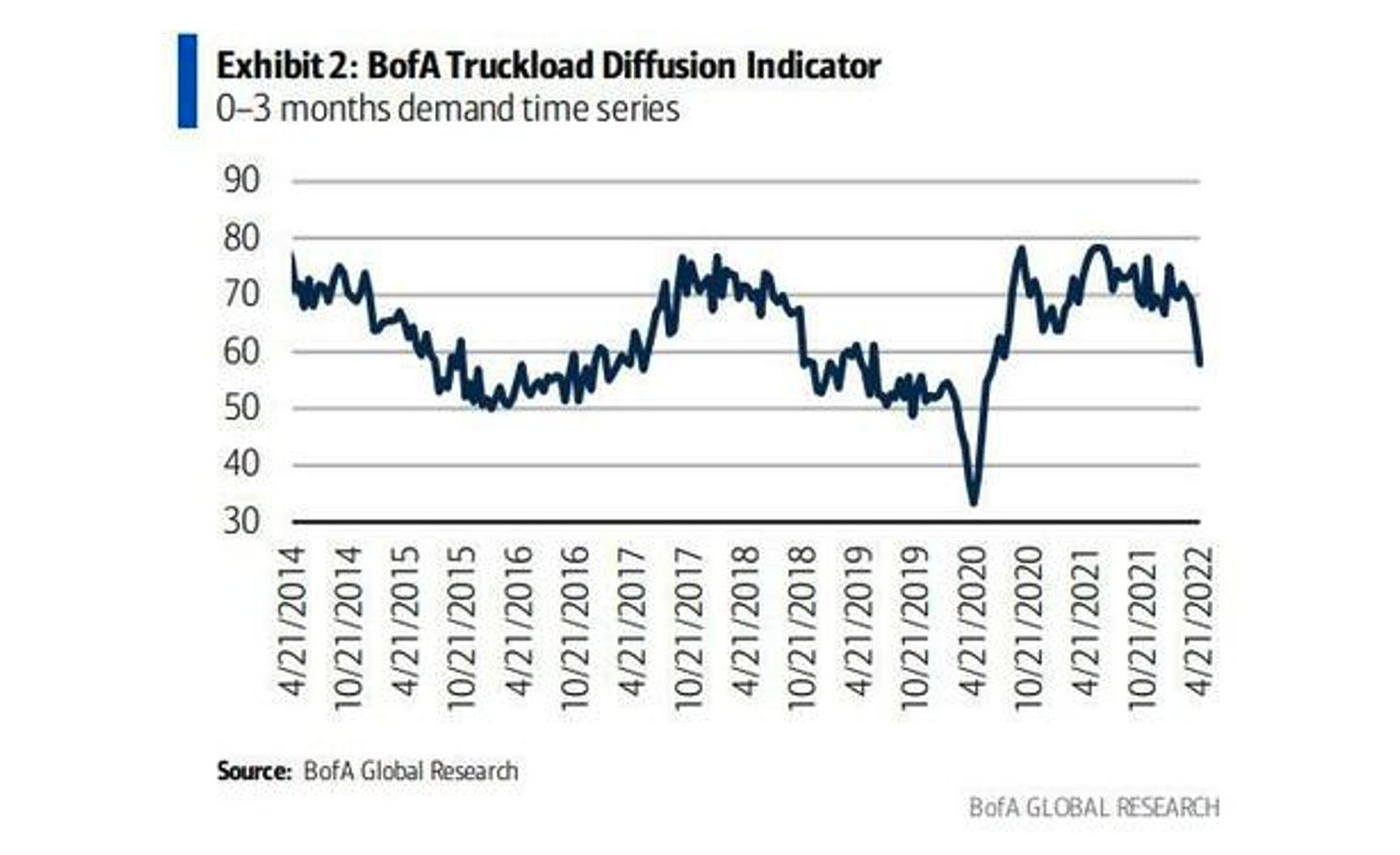

We’ve previously noted a developing glut in trucking capacity that began to emerge in January. The downturn in demand for loads to be transported has led to a sharp drop in shipping rates and a decline in the volume of goods moved via this important economic artery not seen since 2019.[3]

Industry observers are blaming several influences. First, consumers are pulling back from restocking goods after the pandemic recovery and diverting more discretionary income to travel and leisure. Second, the steadily rising costs of food, fuels, and energy are permeating the price structure of virtually everything needed to survive. Inflation is forcing consumers to make unattractive choices.

Finally, lockdowns in several of China’s major ports have again raised concerns about supply chain constraints. All these factors are leading to declines in demand and rates for shipping containers and truckloads. Gauges of industry demand are at levels suggesting a “trucking recession” is looming.[4] The chart below, courtesy of Bank of America, shows the decline in short-term demand for truckloads that began to accelerate early this year.

From the article accompanying the chart:

"Freight is often looked at as a bellwether for the rest of the economy. If industries ranging from retail to housing to lumber are estimating that they’ll need fewer truckers, many economists see that as an omen of an economic downturn. If people aren’t buying or building as much stuff, there’s less of a need for truckers. Trucks move 72% of all freight."[5]

The inescapable conclusion from this analysis is that consumer spending, which represents roughly 70% of GDP, is at best being increasingly spent to satisfy pent up demand for entertainment and travel, or at worst, in the early stages of an overall pullback in response to the soaring cost of living. A slowdown in the economy would help to relax upward pressure on prices, but a recession is not a pleasant experience for most individuals.

Congress also has a role to play in stamping out rising prices, but so far, does not appear to understand the impact deficit spending has had on inflation, which is the equivalent of a universal, regressive tax on American consumers.

Currently, two bills are being considered on Capitol Hill, which, if enacted, would appropriate roughly $360 billion of borrowed (printed) money. The Biden Administration has requested $10 billion in additional Covid relief funds and the Senate is debating a $350 billion “America Competes” bill passed by the House last month. The bill appears primarily to consist of so-called “corporate welfare.”[6]

If we stipulate that legislative spending creates growth in the money supply, clearly Congress is exacerbating inflation if these bills are implemented. The Fed can raise rates to the moon but if there is no slowing of money supply growth, vast amounts of cash will continue to flood the economy and fuel demand (and inflation) without commensurate increases in supply. Senators and Representatives have not received the message that deficit spending must be curtailed in concert with tighter money if spiraling prices are to be brought under control.

Watching the markets daily has been an emotional roller coaster and, in our view, not a productive undertaking for most investors as declines and advances materialize seemingly out of thin air at any moment. Those attempting to divine short-term trends are likely hopelessly confused.

The surprise decline in first-quarter GDP[7] was a warning shot and despite the Biden Administration’s characterization that the net loss was “technical,”[8] nonetheless, the US consumer has now become encumbered by stagflation: slow growth and high inflation.

Investors have endured trying circumstances so far in 2022 and the outlook over the next several quarters does not appear much different. Maintaining the discipline to stick to individual investment plans will ensure that when markets ultimately turn up, portfolios will participate.

Byron A. Sanders

Chief Economist

[1] “Fed Lifts Interest Rates by Half Point in Biggest Hike Since 2000,” www.wsj.com, May 4, 2022.

[2] Ibid.

[3] “Just 3 years after 2019’s trucking bloodbath, another is on the way,” www.freightwaves.com, March 24, 2022.

[4] "Meltdown": Bank Of America Sounding The Alarm On Collapsing Freight Demand,” www.zerohedge.com, April 26, 2022.

[5] Ibid.

[6] “TEXT OF H.R. 4521, THE AMERICA COMPETES ACT OF 2022,” www.docs.house.gov, January 25, 2022.

[7] “Gross Domestic Product, First Quarter 2022 (Advance Estimate),” www.bea.gov, April 28, 2022.

[8] “Biden Pegs U.S. Economic Contraction on ‘Technical Factors’,” www.bloomberg.com, April 28, 2022.