The Corporate Monarchy

I've recently been doing some overall research on our ESG portfolios, and have spent some time in one of our evaluation tools, YourStake.org, which I use for secondary screening of equities and mutual funds. This is a robust tool that allows us to look at various metrics related to Environmental, Social, and Governance benchmarks for individual holdings,

including such things as Animal Exploitation; Bribery, Corruption, and Fraud Violations; CEO Pay to Average Worker Pay Ratios; Deforestation; Environmental Violations; Fossil Fuel Industry Exposure; Migrant Detention Involvement; Prison Industry Exposure; Toxic Air Pollution; and Board Diversity. These are all areas that ESG investors tend to have preferences about, among others, and we screen for acceptable investments for each individual client who has an interest in such things.There's a lot of evaluation involved in understanding the various scores and the underlying data behind them, as well as a lot of nuances related to the extent of violations, causes, and whether or not it is an ongoing problem, or if the company/fund has taken steps to remedy them.

As I reviewed the data, one element stands out when reviewing the companies in the S&P 500 - the ratio of CEO to average worker pay.

For the vast majority of investors, this is typically overlooked. Our culture in the U.S. tends to value skill and expertise, and many people feel that if a company is performing well, the pay of the CEO / Management is inconsequential. And certainly, the industry characteristics need to be considered as well as many other factors when making a judgment about any of these metrics. However, there is much evidence that the incomes of corporate leaders have far outpaced those of the average worker over the last few decades.

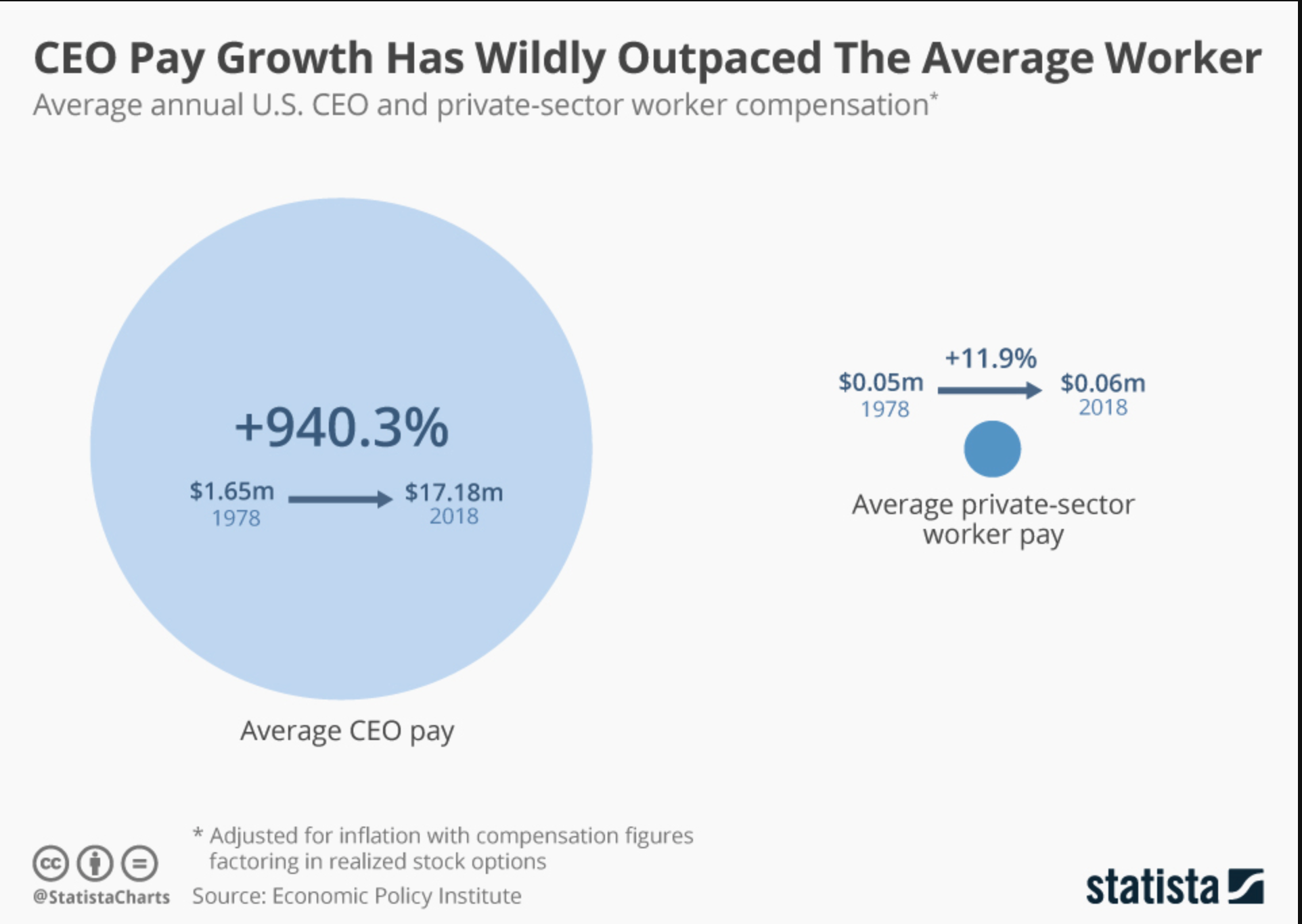

According to Statista, average CEO pay has increased 940.3% since 1978, whereas the average worker pay increase over the same timeframe is 11.9%.

https://www.statista.com/chart/19036/ceo-and-private-sector-worker-compensation/

And at the top of the list of imbalance ratios, we have the following 8 companies, to give you a little perspective on the high end of CEO: Worker Pay.

https://www.statista.com/chart/25332/largest-ceo-to-worker-pay-ratios-at-s-p-500-companies/

I ran a report, and you can see the output for yourself if you are interested. Any cell marked with a "1" on the report shows you a possible flag for exclusion for that particular metric. Of all the companies in the S&P 500, the number flagged for possible exclusion is 435 out of 500 companies. In other words, 87% or all the companies in the index have CEO to Average Worker Pay ratios that are of potential concern.

What does this mean for the average ESG investor, and ESG investing in general? If you define worker pay equality as an issue for you, this situation certainly narrows the field of potential investments. From the standpoint of the growing popularity of ESG investing, perhaps more attention to these rankings will encourage more shareholder pressure for companies to be more equitable in their pay structures, but until then, this is a significant problem for Wall Street and our corporate culture in the U.S.

Even if you don't classify yourself as an ESG investor, this should still be a concern. Governance decisions made by companies affect the returns to shareholders, and this is one marker as to how corporate culture can impact profitability and worker satisfaction, which certainly has an impact on corporate performance.

That said, there's little chance of any significant attitude adjustments at our public corporations, (and public redistribution through higher taxation is not a viable solution) so for most investors, this will not be a factor in deciding whether or not to invest in a particular company. But if it is meaningful to you, we have the tools to make an independent evaluation. Just know that the ability to build a portfolio that focuses on "fairer" corporate compensation arrangements will be limited for the time being.

--Doug Kinsey, CFP®, CIMA®

Partner, Chief Investment Officer

Interested in scoring your individual ESG preferences? You can access a quick questionnaire here.