May 29, 2020

Equities in the US emerged from an early May holding pattern with a strong upside move over the past two weeks. Various news items have been given credit for the surge, including rumored progress on a Coronavirus vaccine and continuing downtrends in the rates of infections in partially reopened states.

But, in our view, the salient factors that have sparked a now better than six week rally are the growing prospect of a relatively quick resumption of economic expansion and the realization that even after significant price gains, many individual equities still offer high expected returns.

Since May 15, through the 28th close, the S&P 500 has risen 2.6%. This is without doubt, an impressive move, which would translate into an annualized rate of more than 60%. However, there is another dynamic at work in the US equity markets. In the same 13 day period, the Russell 2000 benchmark for small capitalization equities soared 11.4%.

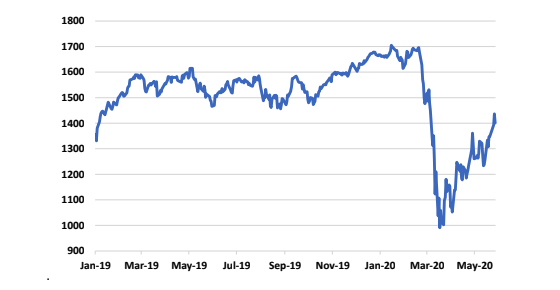

The Russell index remains well below its August 2018 all-time high, as does the S&P, which posted its comparable high this past February. But what this percentage disparity demonstrates is that the rally begun by the NASDAQ tech giants at the end of March is spreading to riskier, less liquid, but equally important market sectors. Closing prices for the Russell 2000 since the beginning of 2019 are shown below.

.

Source: Quotestream online quotation platform, www.quotemedia.com

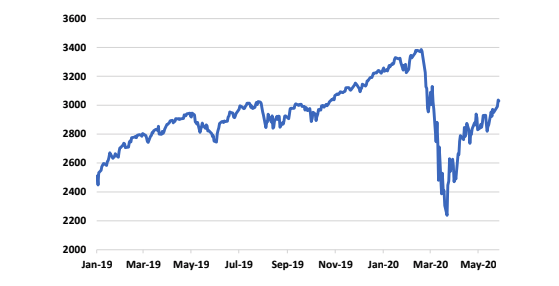

Contrast the above recovery with that of the S&P 500, below.

Source: Quotestream online quotation platform, www.quotemedia.com

These charts are less important because of the similarities in the declines and sharp rebounds than as illustrations that the US equity rally from the March 23 lows has broadened beyond the largest, most visible companies. A market with only limited participation is almost always on shaky ground after a strong advance. If there are “supporting actors,” however, such as the small companies represented in the Russell 2000, the staying power of an uptrend should be enhanced.

We certainly don’t intend to imply that these two charts are predictive of anything in terms of future performance, but the fact that the equity recovery has widened as it has matured is a positive that could translate into a sustainable advance.

But are there dangers that could blunt further gains or send prices back down?

Investors are already prepared to view the worst economic statistics since the Great Depression over the next few weeks as April and subsequently, May reports are released. The magnitude of upcoming negative economic performance is not unexpected and should have little more than transitory impact on not only prices, but also emotions.

What could surprise would be a strong resurgence of the COVID-19 virus in areas that have reopened for business since early May. Should a spike in new infections begin to emerge, pressure to reimpose shutdown orders could puncture market optimism.

To date, however, states that have allowed citizens to resume limited contact in previously shuttered environments such as beaches, malls, restaurants, and barbershops/beauty salons have not reported reversals of new case downtrends observed prior to reopening orders.[1] New hotspots are developing in South America, notably Brazil, but in the US, the rate of new cases and deaths continues to decline.[2] All 50 states are now in some phase of reopening, which can reasonably be expected to expand going forward.[3] The worst of the pandemic in the US has passed, absent a second wave in the fall, a prospect which remains speculative.[4]

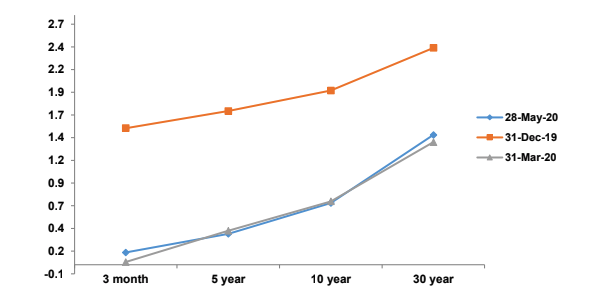

We haven’t spent much time discussing fixed income trends since the Fed essentially took over the credit markets in late March. Interest rates have fluctuated in a very narrow range and have rebounded modestly at all maturities on the Treasury yield curve as equity prices have improved. Funds “parked” in risk-free, short term Treasury instruments are being redeployed into assets with potentially greater returns such as equities, reflecting growing confidence in an economic recovery later this year. The US Treasury yield curves as of December 31, 2019, March 31, and May 28, 2020 are shown below.

Source: Quotestream online quotation platform, www.quotemedia.com

While the shortest and longest maturities have seen yields drift slightly higher since the end of the first quarter, the Fed’s presence in the credit markets as a buyer with virtually unlimited purchasing power is clear. We see little reason to expect any meaningful change in interest rate levels in the foreseeable future, possibly well into 2021 as the Fed maintains its posture as the ultimate provider of liquidity and stability.

As the fourth quarter of 2020 approaches, we should see meaningful improvement in the tenor of economic reports if the equity market’s current optimism is well founded. At present, the best we can hope for in the third quarter is no further deterioration. Unfortunately, no viable technique exists that will allow us to know in advance. Suffice to say that while plenty of warnings about “too hasty” reopening abound, investors, as always, are focusing on the future and clearly looking beyond the current statistical climate.

There are likely to be setbacks for the equity markets as the country progresses through summer and the pace of economic activity begins to increase above life support levels. Vaccine/inoculation successes, failures and rumors will be liable to impact the markets over the short term, but it is an unmistakable conclusion that the third quarter of 2020 has a high probability of being the shutdown induced recession’s trough.

It is a sad reality that significant numbers of small businesses forced to close in the past three months will not reopen and that many lost jobs will not be regained. However, equally likely is that new businesses and jobs will be created in the next expansion, ultimately replacing those which did not survive. Progress is inevitable.

Patient investors have endured a rough ride and now are enjoying a significant recovery. There will inevitably be market declines as the economy struggles to regain strength but, of course, it is impossible to forecast when or to what extent.

We’ve waited out the virus and now must wait out the recovery.

Byron A. Sanders

Investment Strategist

©2020 Artifex Financial Group LLC

[1] CDC and other federal and state reporting agencies.

[2] Ibid.

[3] “All 50 States Are Now Reopening. But at What Cost?,” www.nytimes.com, May 20, 2020.

[4] “How long will the coronavirus last and will there be a second wave? Here's what we know,” www.cnet.com, May 26, 2020.