The Road to Recovery - May 2020 Market Commentary

June 4, 2020

The April global equity rally continued through May, extending the strong gains registered since the markets’ lows in late March. Additionally, volatility has diminished. May was characterized by several stretches of remarkably quiet sessions punctuated by swift, sudden upswings that accounted for the bulk of the month’s performance.

International and Emerging Markets equities are participating in the general price recovery but, so far, to a lesser extent than their US counterparts. The recent proposal by the European Union of a nearly $2 trillion stimulus package has contributed to a rekindling of EU investor hopes and could well spark increased enthusiasm heading into the summer.[1]

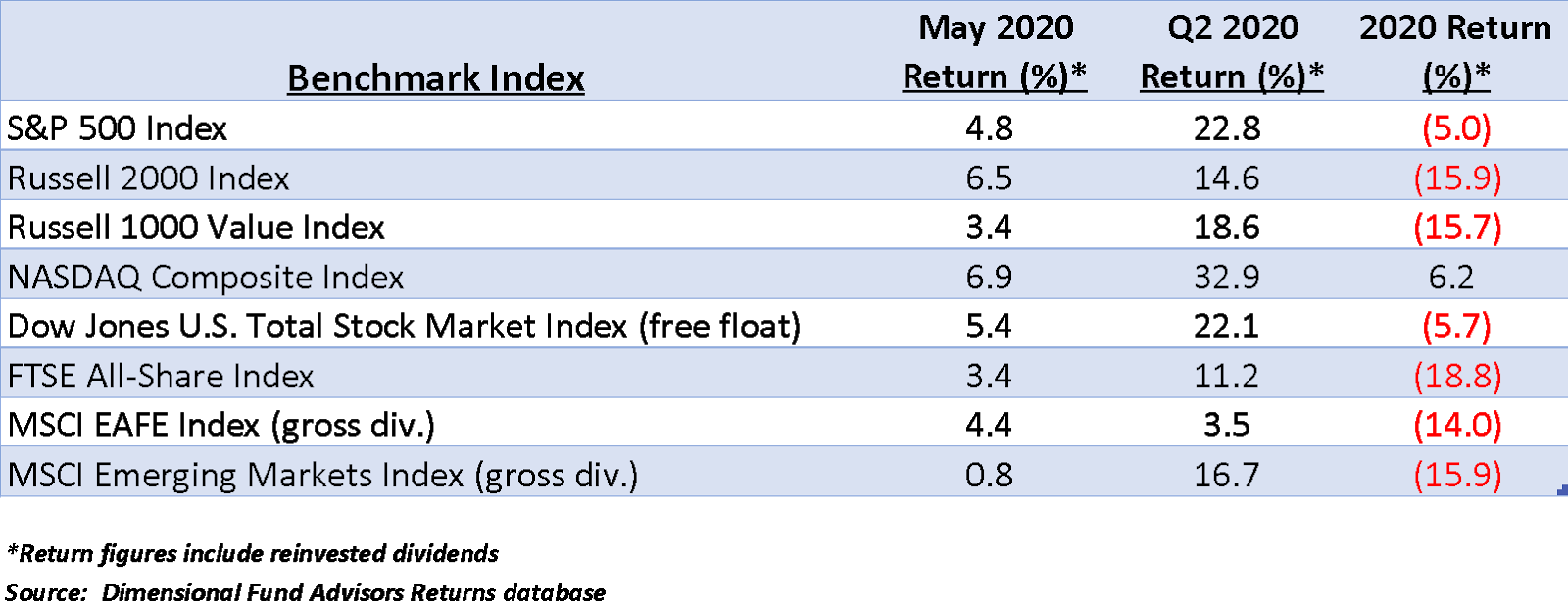

Despite a solid May, price gains for non-US Developed Markets represented by the MSCI EAFE index are notably lagging peers as global markets recover from the Coronavirus selloff. Highly volatile Emerging Markets stocks, in contrast, have posted strong gains for the second quarter to date but cooled in May. The table below illustrates performance of representative global and domestic equity benchmark indexes for May, the second quarter to date and since January 1, 2020.

Prior to the February-March plunge, we had noted several times over the previous six months that small cap and value equities in the US were emerging from a long period of dormancy. The tendency of these less liquid, less visible stocks to move in spurts compared to the more persistent trend of large cap and growth companies has given way in the last two months to a more sustained uptrend as markets continue to rebound.

Small cap and value equities offer higher expected returns for investors as compensation for their inherently higher risk. They are generally more volatile than large cap and growth equity asset classes but historically, as part of a diversified portfolio, have been important sources of performance.

The upswing by these equities since the March lows is a strong signal that investors’ appetite for risk is expanding. In our view, there can be no clearer indication that markets are anticipating an impending economic recovery.

In the US and globally there are growing indications that the worst of the shutdown impact has been passed from both a statistical and psychological standpoint. Employment numbers in the US are still dismal and not likely to show significant improvement until at least July’s report, but amid the detritus of a government mandated recession, global and domestic activity is resuming.

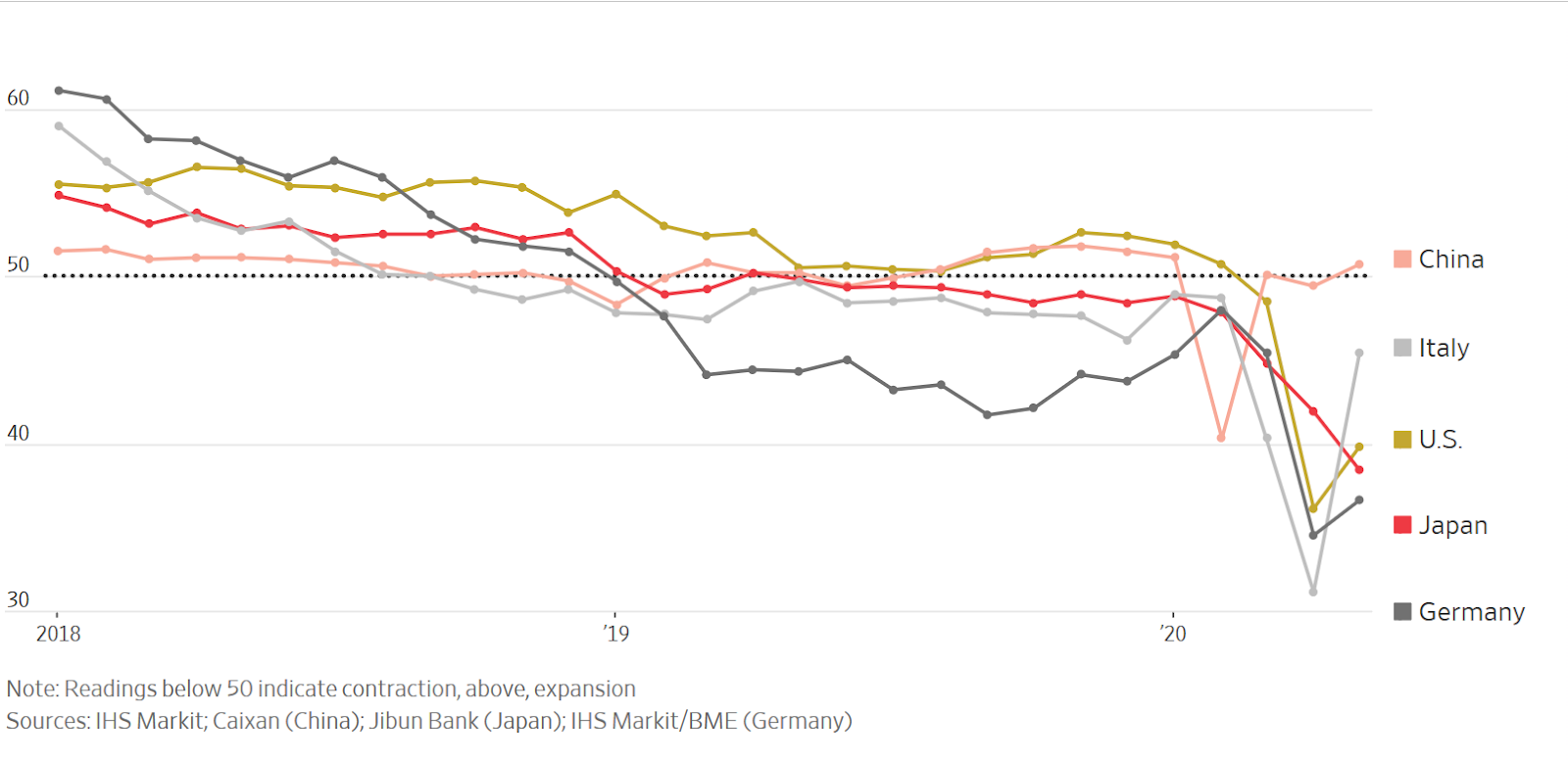

The chart below shows the Manufacturers Purchasing Manager Indexes for the countries noted in the legend, through May. Levels remain below 50, except for China, indicating ongoing contraction. A strong bounce is evident in the latest report, albeit merely to a less negative degree. Further improvement in these benchmarks over the coming months is likely.

Reprinted by permission from The Wall Street Journal, www.wsj.com, June 1, 2020.

Should we take China as a reliable indicator for the global economy’s future? Will resentment tied to the Coronavirus coupled with the realization that widespread reliance on China-based supply chains revealed unacceptable vulnerability this Spring lead to material changes in how the world does business?

China’s economy was faltering under a crushing burden of debt and trade sanctions prior to the onset of the pandemic and resulting economic shutdowns across the globe[2] The trade agreement signed with the US in January was a lifeline, but has come under scrutiny domestically and in this country. China’s problems have been exacerbated by the threat of further deterioration in its position as the “global Amazon” for developed economies. Decisions by trading partners to repatriate manufacturing, especially by the US, could torpedo China’s immediate economic future.

The world’s second largest economy is export based. For several decades, growth has been underpinned by global demand for products and product components China manufactures at substantial cost discounts to alternative sources in the US and other Developed markets.

Chinese internal statistical reports confirm that a large percentage of factories have reopened and are ready to ramp up production. There is a problem, however. Demand for the output from these factories has plunged, threatening to derail the Chinese recovery. If permanent, or at least prolonged, the drop-off could impact expansion beyond the initial rebound. Non-manufacturing activities such as construction, aviation and software development are doing well, but the real engine of past growth has been exports.[3]

It is unknowable whether overseas buyers will remain committed to supply chain repositioning once the pandemic’s impact is overcome and global economic activity returns to normal. As the below Hang Seng index chart shows, even before the recent stripping of Hong Kong’s autonomy by mainland China, in violation of its 1997 treaty with the UK,[4] [5] investors had expressed a less sanguine outlook than evident in other global markets.

Source: Yahoo Finance historical data, www.finance.yahoo.com

China has begun to exploit the fact that its recovery is roughly a month ahead of the rest of the world. Sabre rattling against Taiwan and troop incursions into India along a disputed border are clear indications that China is seeking advantage against Western governments preoccupied with restarting their economies.[6] [7]

Ongoing civil unrest in the US is also a factor. Not only China, but other adversaries and allies have begun to discount American global influence with a “wait and see” attitude addressing the November Presidential election. Their theory appears to be that internal distractions have diminished the US’s global leadership credentials. Moscow, Beijing and even Germany believe that President Trump has his hands full domestically and that a new President could usher in a more accommodative attitude.[8] We can expect more tests of Mr. Trump’s resolve on a variety of international fronts as the election approaches.

Second quarter US statistics are likely to be the worst of the lot and as has been reiterated ad nauseum, will deliver numbers comparable to the Great Depression. One fact worth considering is that for GDP growth, especially, it will be a long way to just get to zero. We expect annualized third quarter GDP to “improve” to roughly flat, which would be a significant achievement.

The fourth quarter could show growth that appears extraordinary. But, of course, any improvement from zero will be a tremendous percentage improvement. As 2021 unfolds, it is likely that growth rates will level off and return to the 2%-3% annual range in line with historical expansion trends.

But there is an unrecoverable chunk of growth suppressed this Spring that is lost forever.

United States history is replete with recovery from adversity, adaptation, innovation, and progress. Its equity markets are extremely efficient leading indicators. Adversity will be the tenor of upcoming statistical reports and let us not ignore that most equity indexes retain significant losses for 2020, despite gains of from 50%-70% from the March 23 lows.

It is our belief that the decline in equity values, job losses and business failures resulting from the 2020 shutdown will ultimately be recovered. We perceive the current situation as “involuntary creative destruction.” What has been destroyed or damaged will ultimately be replaced, reconfigured, and improved.

Byron A. Sanders

Investment Strategist

©2020 Artifex Financial Group LLC

[1] “EU Plans $2 Trillion Stimulus; Fed’s Beige Book Shows Battered Economy; BOK Cuts Key Rate,” www.wsj.com, May 28, 2020.

[2] “China’s rising household debt a ‘major concern’ as government tries to boost consumption amid trade war,” www.scmp.com, December 4, 2019.

[3] “China’s Barely Begun Economic Recovery Shows Signs of Stalling,” www.wsj.com, June 1, 2020.

[4] “U.S. threatens to strip Hong Kong of special status amid tension with China,” www.cbc.ca, May 27, 2020.

[5] “China threatens 'countermeasures' against UK over Hong Kong crisis,” www.theguardian.com, May 29, 2020.

[6] “China vows to ‘smash’ any Taiwan independence move as Trump weighs sanctions,” www.washingtonpost.com, May 29, 2020.

[7] “China flexing military muscle in border dispute with India,” www.scmp.com, June 4, 2020.

[8] “The World Waits Out Trump,” Walter Russell Mead, www.wsj.com, June 1, 2020.