Rally

February 17, 2020

Domestic equity prices have staged a powerful upsurge since the end of January. Fueled by strong fourth quarter 2019 earnings reports and strength in the US economy, investors have been driving prices steadily higher. So far this month, through February 14, the DJTMI has posted only two down days out of 10 trading sessions.

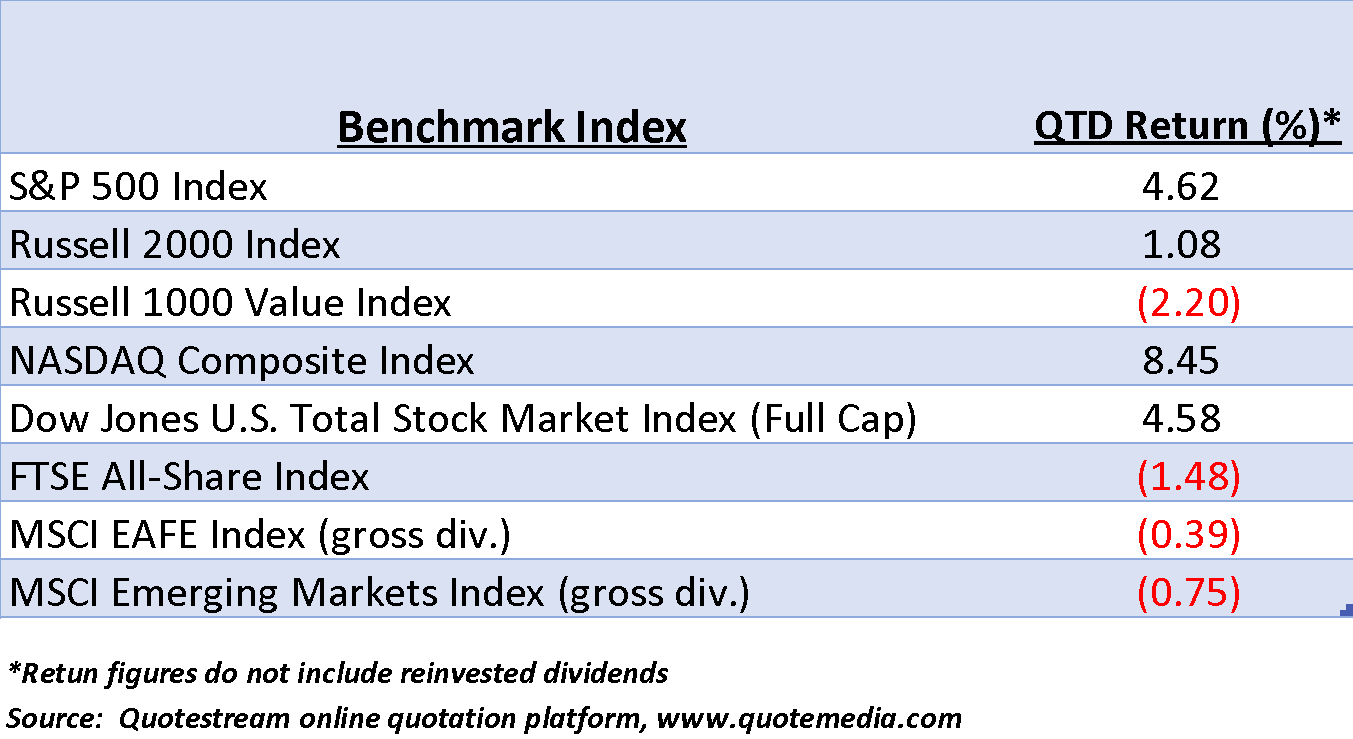

The advance has been led by large-capitalization issues with small capitalization and value equities lagging. We would expect these riskier sectors to catch up should the large-cap rally extend. The table below lists 2020 price changes for representative global indexes at the midpoint of the first quarter.

Gains for broad-based US large-cap indexes are impressive at roughly 4.5%, but it is the NASDAQ Composite that is “shooting the lights out.” One caveat, however, is that this index, comprised of a bit more than 2700 individual equities is overly vulnerable to the action of a handful of companies such as Amazon (AMZN), Apple Inc. (AAPL), Alphabet Inc. (GOOG) and Microsoft (MSFT).

The index is market capitalization-weighted and had a total capitalization (market value) of $13.75 trillion as of February 14. As of the same date, the four companies listed above each have a total capitalization in excess of $1 trillion. Together, they currently represent roughly $4.9 trillion or approximately 35% of the total index market value. We don’t intend to minimize the strong performance of these giants’ share prices, just to illustrate that a relatively small number of “tails” can wag the NASDAQ “dog.” In both directions.

In addition to relatively lackluster action in the small and value sectors of the US markets, the above table confirms that International and Emerging market equities have not performed well up to this point in the quarter.

Credit markets in the US have drifted narrowly lower over the past two weeks but without material change in the yield relationships between various key Treasury maturities. However, one item of note, peripheral to this arena, is the Dow Jones Utility Average (DJUA).

The DJUA tracks of the performance of 15 prominent US utility companies. Utilities are hybrid securities, exhibiting characteristics of both bonds and equities. Their relatively high dividend yield links their prices to the direction of interest rates. In other words, when bond rates rise (and prices decline) the price of utilities similarly rise or decline to maintain dividend yield levels in line with the interest-rate climate.

However, these stocks are traded on exchanges, like any other equity. Their prices are subject to the expectations, fears and confidence of investors and can occasionally trade at discounts or premiums to their “proper” yield.

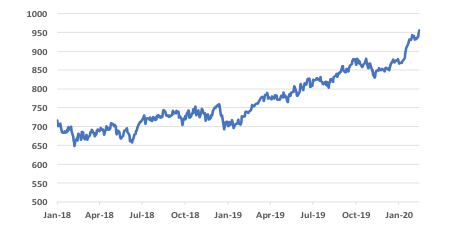

Since the beginning of 2020 the DJUA has been among index performance leaders and has posted a series of all-time highs, with the most recent on February 14. For the year to date, the index is up more than 8.6%, exceeding the 8.5% gain by the NASDAQ Composite Index.

A Wall Street aphorism is that when stocks, bonds and utilities are all in uptrends, the outlook for both the equity markets and the economy is very favorable. Strength in the DJUA can be reasonably interpreted as an indication that demand for electrical power is expanding in the context of robust economic activity, enhanced by interest rate declines. Below is a chart of the DJUA’s performance since the end of 2017.

Source: Quotestream online quotation platform, www.quotemedia.com

Two statistics published during the first half of February provide additional confirmation that the US economy remains in expansionary mode. The January Employment report posted an increase in hiring that significantly exceeded analysts’ expectations. The 225,000 new jobs created last month moved the overall Unemployment rate up 0.1% to 3.6% as a result of new workers entering or re-entering the workforce.[1]

Annual wage growth increased 3.1% in January, up from 2.9% in December.[2] Both the job creation and wage growth numbers are consistent with strength in the job market and reflect demand for labor and the need for employers to increase wages to attract desirable workers. The most recent number of unfilled positions reported is 6.4 million as of the end of 2019, compared to an estimated 5.9 million citizens unemployed in January.[3] [4]

A by-product of the robust job market is rising consumer confidence, which, in February’s survey by the Univ. of Michigan, reached the highest level since its last peak in March 2018.[5] The 7.6% increase in the Index of Consumer Sentiment from January’s level was exceeded by a 9.7% jump in the Index of Consumer Expectations, indicating optimism that current economic conditions, from the consumer’s standpoint, are both positive at present and expected to improve going forward.[6]

There is still no reliable estimate or suggestion of to what magnitude the Coronavirus may impact US first-quarter corporate earnings. However, it is reasonable to expect problems for companies relying heavily on Chinese based supply lines. The negative effect on tech issues especially could be far worse than currently imagined.

Apple Inc. (AAPL) reported overnight that it will miss upcoming revenue targets due to virus-related production issues.[7] Walmart (WMT), which has been enjoying strong sales growth in Chinese based stores, has also announced a sharp drop-off in previously projected revenue from this segment of its business.[8] We can expect to hear more revelations in this vein.

Undeniably, it is the Chinese government’s default secrecy and obfuscation that fuels rumors, speculation and uncertainty about the extent of infections and deaths, especially on social media. What has been officially reported is that acknowledged cases have risen to more than 73,000 from 6,000 in the past two weeks as of February 18. The fatality rate is now 2.6%, which has increased from an initial 2%.[9]

One fact points to guarded optimism that the crisis may not have a catastrophic or long term effect on the Chinese economy. As of February 17, both the Shenzhen Composite and the Shanghai Composite Indexes had recovered all the ground lost since their reopening on February 3 after the Lunar New Year break.[10] In the wake the Apple and Walmart releases, however, shares slumped once again. New lows by either index would confirm that the worst of the epidemics influence has not yet been discounted by investors.

It is impossible to quantify the ultimate global economic impact of the Coronavirus outbreak in advance. Logic suggests that a meaningful reduction in Chinese economic activity is a likelihood, but predictions by some pundits of an economic implosion there, at this point, seem overdone.

Despite skepticism regarding the veracity of Chinese statistics and the effectiveness of widening quarantines, the number of confirmed cases in the US remains nominal so far, although more than 700 individuals in Washington state are currently being monitored for signs of the infection.[11].

Investors attempting to avoid negative market reactions to news from China will likely find such decisions counterproductive. They will be far better served by focusing on their long term plans and concentrating on the strong domestic economy. One thing is certain. The disease will eventually run its course and subside.

Byron A. Sanders

Investment Strategist, Artifex Financial Group

Interested in getting some quick answers to key financial planning concerns? Try our new MyBlocks tool. Click below to register:

©2019 Artifex Financial Group LLC

[1] “Employment Situation Survey,” www.bls.gov, February 7, 2020.

[2] Ibid.

[3] “Job Openings and Labor Turnover Survey,” www.bls.gov, February 11, 2020.

[4] “United States Unemployed Persons,” www.tradingeconomics.com, 1940-2020 data.

[5] “Surveys of Consumers,” www.scr.isr.umich.edu

[6] Ibid.

[7] “Apple Shares Drop After Virus Warning Rattles Tech Investors,” www.bloomberg.com, February 18, 2020.

[8] “Coronavirus in China may have severely stunted one of Walmart's hottest businesses,” finance.yahoo.com, February 28, 2020.

[9] “As U.S. plans evacuations for American travelers on cruise ship in Japan, a passenger from another ship turns up with coronavirus,” www.washingtonpost.com, February 15, 2020.

[10] “Chinese Stocks Recover From Coronavirus-Driven Selloff,” www.wsj.com, February 17, 2020.

[11] “Over 700 people in Washington under public health supervision due to coronavirus,” www.krem.com, February 17, 2020.